Thinking of getting an electric car? Great news, you may be eligible for a tax credit! Here’s a step-by-step guide on how to claim the $7,500 federal tax credit for electric vehicles.

Step 1: Check Your Car

First things first, your car must qualify for the tax credit. Only new, plug-in electric vehicles (EVs) and plug-in hybrids (PHEVs) are eligible. Additionally, the vehicle must have a battery capacity of at least 4 kWh, be purchased new (not used), and be registered in your name.

Step 2: Get Your Car’s Documentation Ready

Next, you’ll need to gather some important documentation. This includes the manufacturer’s certification statement, which confirms that the vehicle meets the requirements for the tax credit. You can typically find this statement on the manufacturer’s website or by contacting them directly.

You’ll also need to get a copy of the purchase or lease agreement to show you bought or leased the vehicle in the tax year for which you are claiming the credit. And if you financed the car, you’ll need a copy of the loan agreement as well. Keep all of this documentation in a safe place; you’ll need it when you file your taxes.

Step 3: Calculate the Credit

To calculate the credit, you’ll need to determine the battery capacity of your vehicle. This information can typically be found on the manufacturer’s website or in the car’s manual. The size of the credit is based on the battery capacity and the manufacturer of the vehicle. The maximum credit for a vehicle is $7,500, but it may be less, depending on the battery capacity and manufacturer.

Keep in mind that the credit is non-refundable. This means that if you owe less in taxes than the credit amount, you won’t receive a refund for the difference. However, you can carry the credit forward to future tax years if you cannot use the full amount in the year of purchase.

Step 4: File Your Taxes

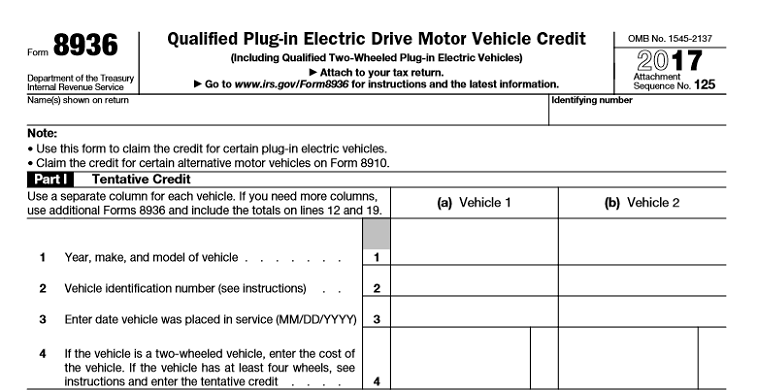

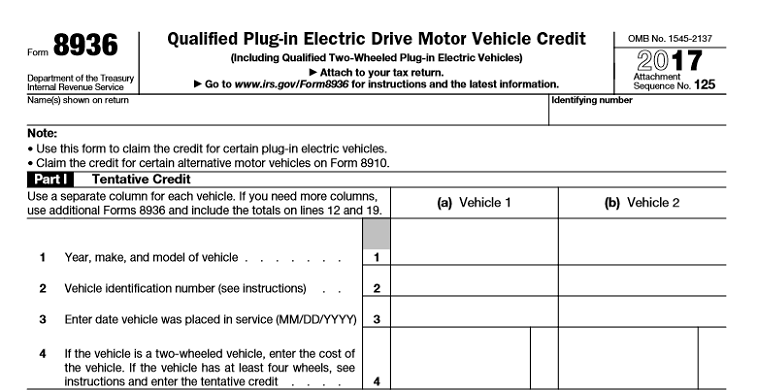

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

When it’s time to file your taxes, use IRS Form 8936 to claim the credit. You’ll need to attach a copy of the manufacturer’s certification statement and the purchase or lease agreement to the form. If you’re claiming the credit for a vehicle you leased, you’ll need to provide additional information on the lease agreement.

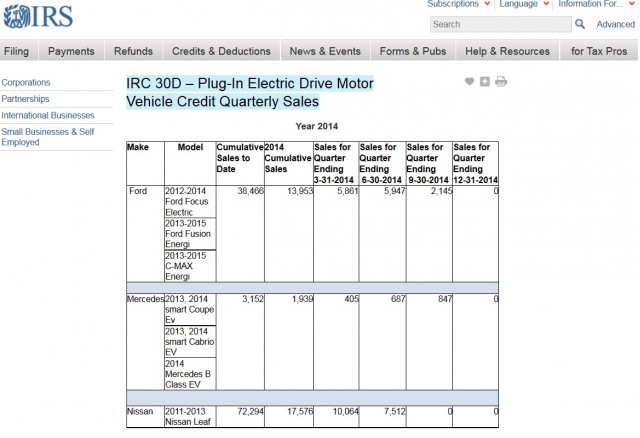

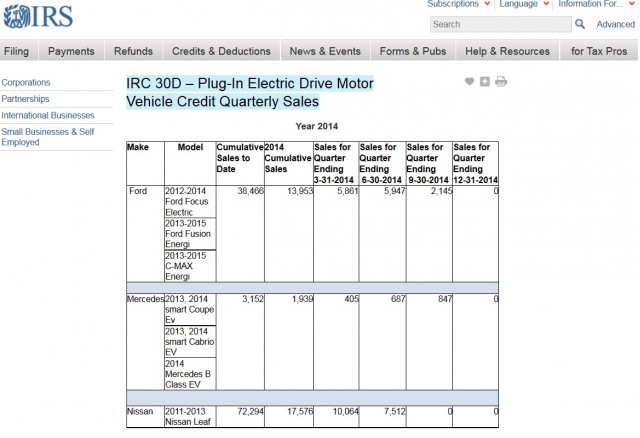

Keep in mind that not everyone is eligible for the full credit. The amount of the credit begins to phase out once a manufacturer has sold more than 200,000 qualifying vehicles in the United States. Some manufacturers, such as Tesla and General Motors, have already reached this threshold, meaning that the credit amounts for their vehicles have been reduced or eliminated entirely.

Additional Information

It’s important to note that the federal tax credit is just one of many incentives available to electric vehicle owners. Some states offer additional tax credits or rebates for EVs, and utility companies may offer incentives for EV charging or installation of charging stations.

It’s also important to consider the long-term savings of an electric vehicle. Not only can you save money on gas, but EVs require less maintenance than traditional gasoline vehicles, potentially saving you money in the long run.

Conclusion

While buying an electric vehicle can be a big investment, the tax credit can make it more affordable. By following these steps, you can ensure that you’re eligible for the credit and maximize your savings.

Remember, it’s important to do your research and consider all factors, including the long-term savings and environmental impact, before making a decision about buying an electric car.

Good luck and happy driving!

Additional Resources:

- IRS Form 8936

- Federal Tax Credits for Electric Vehicles

- Alternative Fuels Data Center - Electric Vehicle Tax Credit

State Tax Credits:

While the federal tax credit is available to all qualifying electric vehicles, many states also offer incentives for EV owners. Here’s a breakdown of some of the state tax credits available for electric and plug-in hybrid vehicles:

- California: $2,000 for new battery-electric vehicles and $1,000 for new plug-in hybrids

- Colorado: Tax credit of up to $4,000 for qualifying vehicles

- Connecticut: Rebate of up to $5,000 for new battery-electric vehicles, and up to $3,000 for new plug-in hybrids

- Delaware: $2,500 rebate for new battery-electric vehicles, and $1,000 for new plug-in hybrids

- Hawaii: Tax credit of up to $2,500 for qualifying vehicles

- Illinois: Rebate of up to $1,000 for new plug-in hybrids, and up to $4,000 for new battery-electric vehicles

- Maryland: Rebate of up to $7,500 for new battery-electric vehicles, and up to $3,000 for new plug-in hybrids

- Massachusetts: Rebate of up to $2,500 for new battery-electric vehicles, and up to $1,500 for new plug-in hybrids

- New York: Rebate of up to $2,000 for new battery-electric vehicles, and up to $1,100 for new plug-in hybrids

- Oregon: Rebate of up to $2,500 for new battery-electric vehicles, and up to $1,500 for new plug-in hybrids

- Pennsylvania: Rebate of up to $1,750 for new battery-electric vehicles, and up to $1,000 for new plug-in hybrids

- Tennessee: Tax credit of up to $2,500 for qualifying vehicles

- Utah: Tax credit of up to $1,500 for qualifying vehicles

- Vermont: Rebate of up to $5,000 for new battery-electric vehicles, and up to $2,500 for new plug-in hybrids

Be sure to check with your state’s Department of Energy or Environmental Protection Agency for the most up-to-date information on state incentives for electric vehicles.

Reporting Discrepancies

While the federal tax credit for electric vehicles has been in place for several years, there are still reporting discrepancies with the Internal Revenue Service (IRS). The Office of Inspector General (OIG) for the Department of Treasury has found that there are errors in the IRS’s process for reviewing and verifying electric vehicle tax credits.

The OIG found that the IRS has not established adequate procedures to verify the battery capacity of the vehicles and has not consistently identified and addressed discrepancies in taxpayer filings. In some cases, taxpayers have claimed the full credit for vehicles with smaller battery capacities, while others have failed to complete the certification process.

If you’re claiming the electric vehicle tax credit, make sure that you have all of the necessary documentation and that you are claiming the correct amount. If you’re unsure about anything, consult with a tax professional to ensure that you are in compliance with all IRS regulations.

If you are looking for Electric Vehicle Tax Credit Update For New Models | Fuoco Group you've came to the right place. We have 8 Pictures about Electric Vehicle Tax Credit Update For New Models | Fuoco Group like Federal tax credit reinstated for 2018-2020 EV purchases and chargers, Claiming the $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide and also Electric Vehicle Tax Credit Update For New Models | Fuoco Group. Here you go:

Electric Vehicle Tax Credit Update For New Models | Fuoco Group

www.fuoco.cpa

www.fuoco.cpa kaplan

Federal Tax Credit Reinstated For 2018-2020 EV Purchases And Chargers

ev4corners.org

ev4corners.org Claiming The $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide

www.cheatsheet.com

www.cheatsheet.com irs claiming forms cheatsheet

A Complete Guide To The Electric Vehicle Tax Credit

www.greenmatters.com

www.greenmatters.com State Electric Vehicle Tax Credits - Electric, Hybrid, & Alternative

20somethingfinance.com

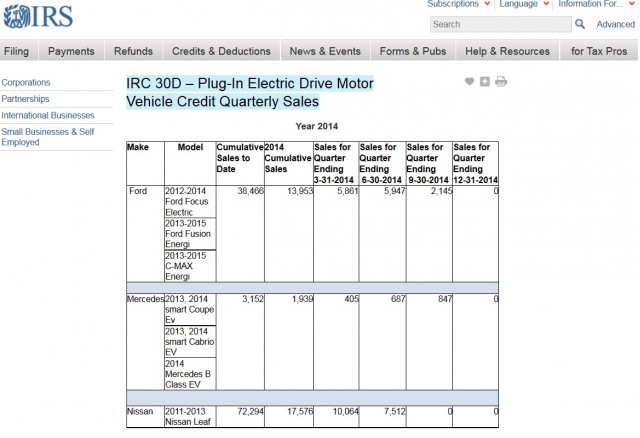

20somethingfinance.com IRS Electric-Car Tax Credits: Reporting Discrepancies Remain

www.greencarreports.com

www.greencarreports.com electric tax car irs credit sales vehicles qualifying plug purchase nov credits reporting discrepancies remain

Electric Vehicle Tax Credit: What To Know For 2020 – Action News Jax

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) www.actionnewsjax.com

www.actionnewsjax.com calculate

How Does US Federal Tax Credit For Electric Vehicles Work? | Update On

www.emobilitysimplified.com

www.emobilitysimplified.com Irs electric-car tax credits: reporting discrepancies remain. Electric tax car irs credit sales vehicles qualifying plug purchase nov credits reporting discrepancies remain. Claiming the $7,500 electric vehicle tax credit: a step-by-step guide

0 Comments