Electric vehicles have been gaining popularity worldwide, and Jordan is no exception. With the increasing demand for electric cars, the government has made significant efforts to encourage Jordanians to make the switch to electric cars. However, recent changes in electric vehicle tax in the country have come as a surprise to many.

The Electric Vehicle Tax Increase in Jordan

The new regulations have increased the tax on electric vehicles from 20% to 30%. This increase came as a surprise to many, as the government had previously encouraged the use of electric vehicles to reduce carbon emissions and decrease the country's dependence on expensive imported oil.

Electric vehicles have several benefits over traditional gasoline vehicles. They are environmentally friendly and produce far fewer emissions, contributing to cleaner air and less pollution. In addition, electric vehicles are cheaper to operate in the long run, as they are more energy-efficient and require less maintenance. However, the new tax increase may discourage some Jordanians from switching to electric cars.

A Complete Guide to the Electric Vehicle Tax Credit

In contrast to Jordan's recent tax increase, many other countries offer incentives for purchasing electric cars. The biggest incentive currently available in the United States is the Electric Vehicle Tax Credit. This tax credit is available to individuals who purchase an electric vehicle, and it can greatly reduce the cost of the car.

The Electric Vehicle Tax Credit is a federal tax credit that provides up to $7,500 in credit for the purchase of a qualified electric vehicle. The amount of the credit is based on the car's battery size, and the credit is reduced if the car manufacturer has already sold a certain number of electric vehicles.

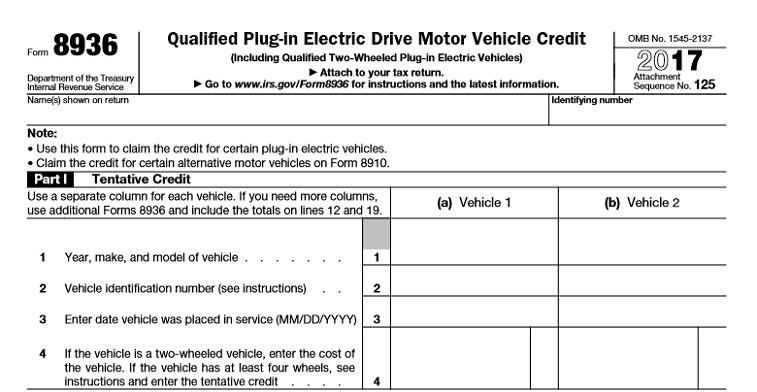

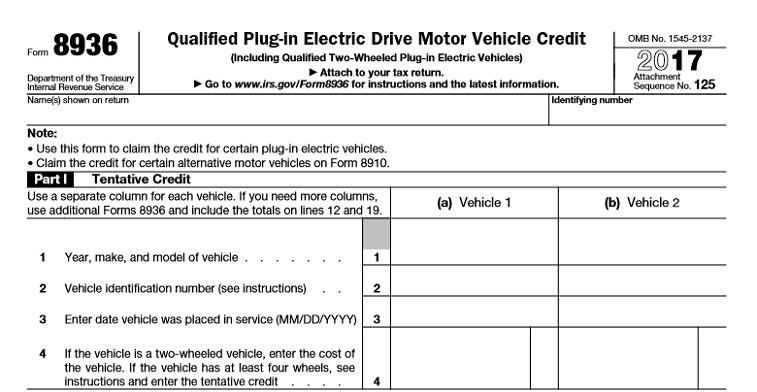

Claiming the Electric Vehicle Tax Credit

To claim the Electric Vehicle Tax Credit, you must first purchase a qualified electric vehicle. Then, you will need to fill out Form 8936 with your taxes. This form allows you to claim the credit and must be submitted with your tax return.

It is important to note that not all electric vehicles are eligible for the tax credit. Only cars that meet certain criteria, such as battery size and speed, are eligible. Additionally, the tax credit is only available for the first 200,000 electric vehicles sold by a manufacturer. Once a manufacturer sells this number of electric cars, the tax credit will begin to phase out for that manufacturer's electric vehicles.

Plug-In Electric Vehicle Tax Credit Amounts

The amount of the Electric Vehicle Tax Credit varies depending on the car's battery size and the manufacturer. The maximum credit of $7,500 is available for electric vehicles with batteries that have a capacity of 16 kilowatt-hours (kWh) or more. Vehicles with smaller batteries are eligible for a smaller credit.

The table above shows the maximum tax credit amounts for electric vehicles from several different manufacturers. These amounts are based on the battery capacity of the car and are subject to change as the number of electric vehicles sold by each manufacturer increases.

What You Need to Know About the Electric Vehicle Tax Credit in 2022

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

The Electric Vehicle Tax Credit has been extended several times since it was first introduced in 2008. The most recent extension was part of the Consolidated Appropriations Act of 2021, which extended the tax credit through December 31, 2021.

As of January 1, 2022, the Electric Vehicle Tax Credit will no longer be available for Tesla vehicles. The reason for this is that Tesla has already sold over 200,000 electric vehicles, and the tax credit begins to phase out for a manufacturer's electric vehicles once that number is reached.

However, other electric vehicle manufacturers, such as Chevrolet and Ford, are still eligible for the tax credit. The maximum credit amount will depend on the manufacturer and the battery size of the car.

Electric Vehicle Tax Credits: What You Need to Know

If you are considering purchasing an electric vehicle, it is important to understand the tax incentives available to you. In addition to the Electric Vehicle Tax Credit, some states also offer their own incentives for electric vehicle owners.

For example, California offers a Clean Vehicle Rebate of up to $7,000 for the purchase or lease of a new electric vehicle. New York offers a Drive Clean Rebate of up to $2,000 for the purchase or lease of a new electric vehicle or a plug-in hybrid.

Some states also offer additional perks for electric vehicle owners, such as access to carpool lanes and free parking. It is important to check with your state's Department of Motor Vehicles to see what incentives are available to you.

The Future of Electric Vehicles and Tax Credits

As electric vehicles become more popular, the availability of tax incentives may change. Some politicians have proposed increasing the Electric Vehicle Tax Credit to encourage more people to switch to electric cars. However, others argue that the tax credit should be eliminated altogether.

Regardless of what happens to the tax credit in the future, electric vehicles are likely to become more prevalent on the roads. As battery technology improves and the cost of electric cars continues to decrease, more people are likely to make the switch to electric vehicles.

Overall, electric vehicles offer several advantages over traditional gasoline vehicles, including lower operating costs and reduced emissions. While the recent tax increase on electric vehicles in Jordan may discourage some from purchasing electric cars, other countries offer incentives for individuals to switch to electric vehicles. It is important to understand the tax incentives available to you and to consider the long-term benefits of owning an electric vehicle.

If you are looking for A Complete Guide to the Electric Vehicle Tax Credit you've came to the right web. We have 8 Pics about A Complete Guide to the Electric Vehicle Tax Credit like Electric Vehicle Tax Credits: What You Need to Know - Doty Pruett and, 'Surprise' Increase on Electric Vehicles' Tax in Jordan | Al Bawaba and also A Complete Guide to the Electric Vehicle Tax Credit. Read more:

A Complete Guide To The Electric Vehicle Tax Credit

www.greenmatters.com

www.greenmatters.com Electric Vehicle Tax Credit: What To Know For 2020 – Action News Jax

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) www.actionnewsjax.com

www.actionnewsjax.com calculate

'Surprise' Increase On Electric Vehicles' Tax In Jordan | Al Bawaba

www.albawaba.com

www.albawaba.com tax electric stacking businessman coins table car shutterstock increase surprise jordan vehicles evs customs increased zero per january been cent

Here’s Why You Should Wait To Buy An Electric Vehicle! (NEW EV Tax

wait

Plug-In Electric Vehicle Tax Credit Amounts (3) | Download Scientific

www.researchgate.net

www.researchgate.net Electric Vehicle Tax Credit Survives In Latest Tax Bill, But Phase Out

www.freep.com

www.freep.com bolt zippy mainstream ev survives incentives congressional conferees dropped wipe

Claiming The $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide

www.cheatsheet.com

www.cheatsheet.com irs step claiming cheatsheet

Electric Vehicle Tax Credits: What You Need To Know - Doty Pruett And

dpwcpas.com

dpwcpas.com ev electrek money qualify

Here’s why you should wait to buy an electric vehicle! (new ev tax. Electric vehicle tax credits: what you need to know. Tax electric stacking businessman coins table car shutterstock increase surprise jordan vehicles evs customs increased zero per january been cent

0 Comments