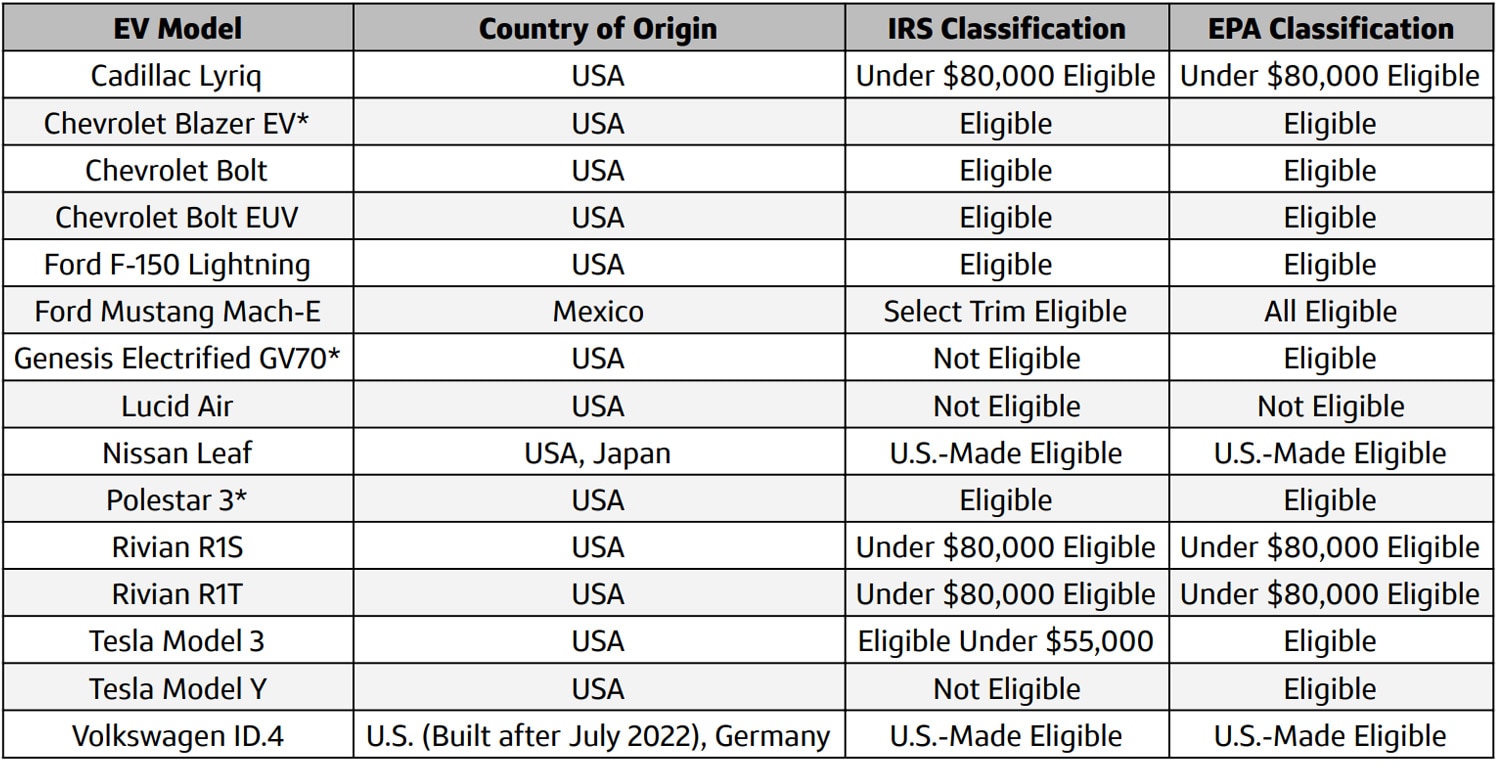

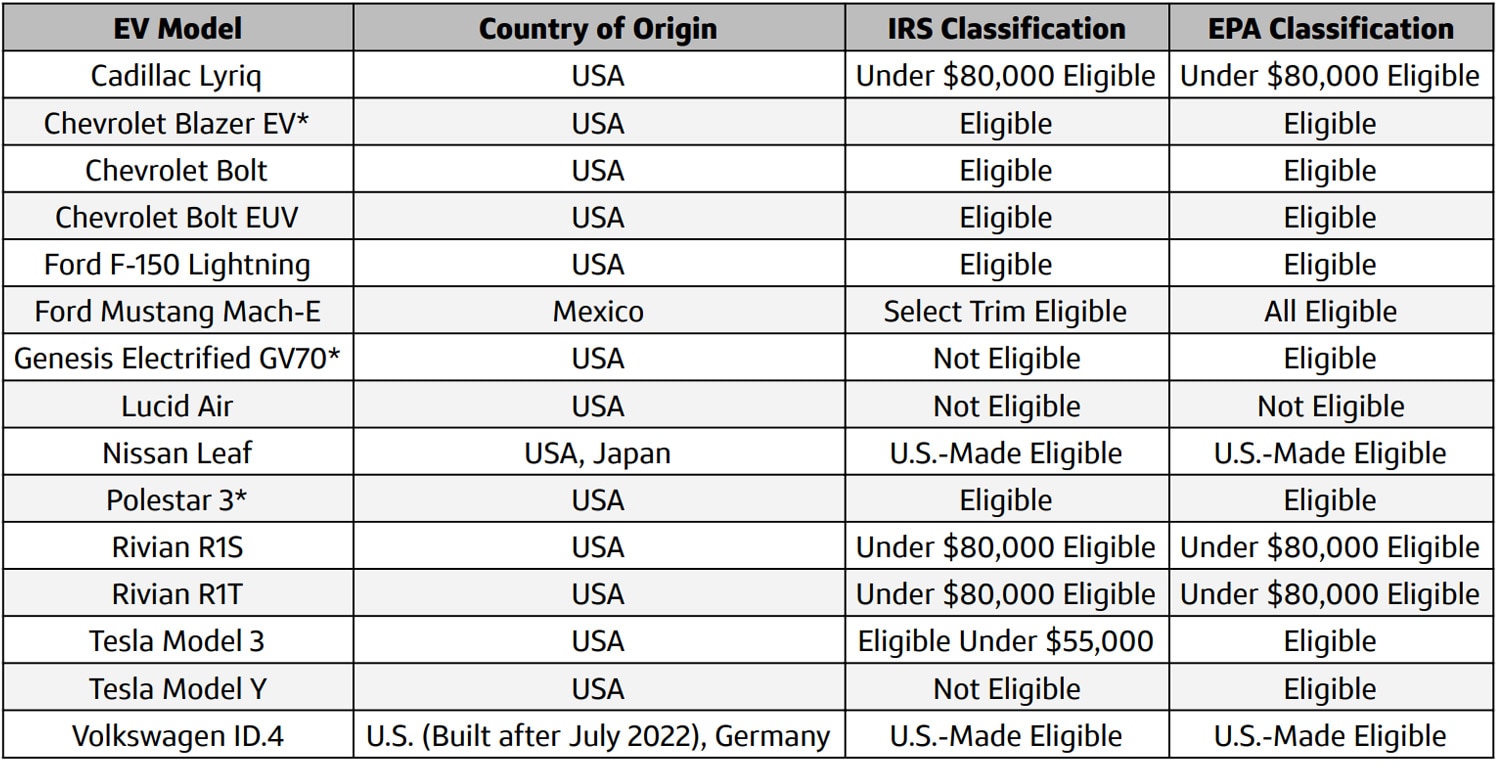

Electric vehicles have been gaining popularity around the world, with their increasing affordability and eco-friendliness. As more and more people make the switch to electric vehicles, they can now take advantage of tax credits that can save them money in the long run. In this post, we will explain the details of the tax credits that electric vehicle owners can receive in the United States in 2021. First on our list of electric vehicles that qualify for the US federal tax credit in 2021 is the Tesla Model S. This electric car is eligible for a tax credit of up to $1,875. However, it is important to note that this tax credit is decreasing over time, and for purchases made after December 31st, 2021, it will no longer be available. Next up is the Chevrolet Bolt, which is eligible for a tax credit of up to $1,875. However, this tax credit will be phased out over time, with the amount decreasing to $1,500 for purchases made from April 1st, 2021, to September 30th, 2021, and then $750 for purchases made from October 1st, 2021, to March 31st, 2022. Another electric vehicle that is eligible for the federal tax credit is the Nissan Leaf. This electric car is eligible for a tax credit of up to $7,500. However, just like other electric vehicles on this list, the tax credit is being phased out over time, and for purchases made after December 31st, 2021, it will no longer be available. Electric vehicles like the BMW i3 are also eligible for the federal tax credit. This electric car is eligible for a tax credit of up to $7,500. However, just like other electric vehicles on this list, the tax credit is being phased out over time, and for purchases made after December 31st, 2021, it will no longer be available. The Ford Mustang Mach-E is another electric vehicle that is eligible for the federal tax credit. This electric car is eligible for a tax credit of up to $7,500. However, just like other electric vehicles on this list, the tax credit is being phased out over time, and for purchases made after December 31st, 2021, it will no longer be available. One electric vehicle that is not eligible for the tax credit is the Tesla Model 3. The reason for this is that Tesla has already sold more than 200,000 electric vehicles, which is the maximum number of electric vehicles that any automaker can sell and still be eligible for the federal tax credit. As a result, electric vehicles from Tesla are no longer eligible for the tax credit. It is important to keep in mind that not all electric vehicles are eligible for the federal tax credit, and the amount of the tax credit that is available varies depending on the make and model of the electric vehicle. However, for those who do qualify for the tax credit, it can help to make an electric vehicle more affordable. One of the benefits of electric vehicles is that they are much more environmentally friendly than traditional gasoline-powered vehicles. Electric cars produce zero emissions, which means that they do not contribute to air pollution or greenhouse gas emissions. As a result, electric vehicles could help to reduce the impact of climate change and improve air quality in cities. In addition to their environmental benefits, electric vehicles are also much cheaper to operate than traditional gasoline-powered cars. Electric cars have lower maintenance costs, as they have fewer moving parts than traditional cars. They also have lower fuel costs, as electricity is much cheaper than gasoline. Another benefit of electric vehicles is that they are much quieter than traditional gasoline-powered cars. Electric cars produce very little noise, which means that they do not contribute to noise pollution in cities. This can help to create a more peaceful and enjoyable environment for people who live in urban areas. Overall, electric vehicles offer a range of benefits that make them an attractive option for many people. From their affordability to their environmental benefits, electric cars are a smart choice for anyone looking to save money and reduce their carbon footprint. Now that we have covered the tax benefits of electric vehicles, let's take a closer look at the different electric vehicles that are eligible for the tax credit. First on the list is the Tesla Model S. This electric car is known for its long range and impressive acceleration. The Model S can travel up to 402 miles on a single charge, making it one of the longest-range electric vehicles on the market. It also has a top speed of 155 mph and can accelerate from 0 to 60 mph in as little as 2.4 seconds. Up next is the Chevrolet Bolt. This electric car has a range of up to 259 miles on a single charge, making it a great option for those who want a long-range electric car at an affordable price. The Bolt also has a top speed of 93 mph and can accelerate from 0 to 60 mph in 6.5 seconds. The Nissan Leaf is another popular electric vehicle that is eligible for the federal tax credit. This electric car has a range of up to 226 miles on a single charge, making it a great option for those who want a long-range electric car at an affordable price. The Leaf also has a top speed of 98 mph and can accelerate from 0 to 60 mph in 7.4 seconds. The BMW i3 is a stylish and eco-friendly electric vehicle that is eligible for the federal tax credit. This electric car has a range of up to 153 miles on a single charge, making it a great option for those who want a long-range electric car with a unique design. The i3 also has a top speed of 93 mph and can accelerate from 0 to 60 mph in 7.2 seconds. The Ford Mustang Mach-E is a new entry into the electric vehicle market, but it has already made a big impression. This electric car has a range of up to 300 miles on a single charge, making it one of the longest-range electric vehicles on the market. It also has a top speed of 124 mph and can accelerate from 0 to 60 mph in as little as 3.5 seconds. Overall, electric vehicles offer a range of benefits that make them an attractive option for many people. From their affordability to their environmental benefits, electric cars are a smart choice for anyone looking to save money and reduce their carbon footprint. And with the federal tax credit available to eligible electric vehicle owners, there has never been a better time to make the switch to an electric car.

If you are looking for Electric Vehicles Qualifying For US Federal Tax Credit In 2021 you've visit to the right web. We have 8 Pictures about Electric Vehicles Qualifying For US Federal Tax Credit In 2021 like Why Are Tesla Electric Vehicles Not Eligible for the Tax Credit?, The power of the tax credit for buying an electric vehicle - MMKR CPAs and also GM Wants Its $7,500 EV Tax Credit Back | The Drive. Here it is:

Electric Vehicles Qualifying For US Federal Tax Credit In 2021

www.austincartransport.com

www.austincartransport.com 2021 tax vehicles electric credit qualifying federal millionaire maker surging mean comes does forward when year but worth

The Power Of The Tax Credit For Buying An Electric Vehicle - MMKR CPAs

mmkr.com

mmkr.com electric tax buying vehicle credit power although percentage evs increasing vehicles road cars re today they small

12v 14ah Battery Dimensions, Used Car Batteries Indianapolis 500

s3.amazonaws.com

s3.amazonaws.com Electric Car Tax: The Benefits Of Electric Vehicles In 2021 | Raw

rawaccounting.co.uk

rawaccounting.co.uk Why Are Tesla Electric Vehicles Not Eligible For The Tax Credit?

www.motorbiscuit.com

www.motorbiscuit.com q4 deliveries tsla tax eligible ena

What Is The New EV Tax Credit? | Capital One Auto Navigator

www.capitalone.com

www.capitalone.com The Tax Benefits Of Electric Vehicles - SJC+0 Accountants In Aberdeen

www.sjcplus0.co.uk

www.sjcplus0.co.uk GM Wants Its $7,500 EV Tax Credit Back | The Drive

www.thedrive.com

www.thedrive.com euv chevy 2022 redesigned unveils elektroautos tax motor1 intros bangshift pressboltnews quattroruote autonomia aktuellste nachrichten hybride plug

12v 14ah battery dimensions, used car batteries indianapolis 500. Gm wants its $7,500 ev tax credit back. What is the new ev tax credit?

mmkr.com

mmkr.com  rawaccounting.co.uk

rawaccounting.co.uk  www.motorbiscuit.com

www.motorbiscuit.com  www.capitalone.com

www.capitalone.com  www.sjcplus0.co.uk

www.sjcplus0.co.uk  www.thedrive.com

www.thedrive.com

0 Comments