Electric vehicles are the way of the future, and with the US Federal Tax Credit program in place, there's never been a better time to invest in one. Not only are electric cars better for the environment, they also offer a variety of tax breaks and benefits that make them an appealing choice for many consumers.

What qualifies for the US Federal Tax Credit in 2021?

If you're in the market for an electric vehicle, it's important to know which cars qualify for the US Federal Tax Credit program in 2021. This program offers a tax credit of up to $7,500 for the purchase of qualifying electric vehicles. Currently, cars manufactured by BMW, General Motors, Ford, and Tesla are eligible for the full credit.

Understanding the Electric Vehicles Tax Credit Program

While the US Federal Tax Credit program is a great incentive for purchasing an electric vehicle, it's important to understand the rules and regulations surrounding the program. The Bethesda CPA offers an in-depth look at the qualifying vehicles and the requirements for receiving the tax credit.

The Benefits of Electric Vehicles in 2021

In addition to the tax credit, electric cars offer a variety of benefits that make them a compelling choice for many consumers. For starters, they're much better for the environment than gas-powered cars. They're also cheaper to maintain, as they don't require oil changes or other routine maintenance associated with traditional cars. Plus, they offer a quiet, smooth ride that's hard to beat.

The Ultimate Guide to Electric Car Tax Credits

If you're looking to take advantage of the US Federal Tax Credit program, the Freedom National blog offers a comprehensive guide to understanding the intricacies of the program. From calculating your tax credit to understanding the income limits and restrictions, this guide has everything you need to know to make an informed decision about buying an electric vehicle.

More Electric Vehicles Qualifying for US Federal Tax Credit in 2021

If you thought your options were limited to just a few cars, think again. With more and more manufacturers producing electric vehicles, you'll have even more choices when it comes to choosing a car that qualifies for the tax credit. For instance, the 2021 Volvo XC40 Recharge and the 2021 Nissan Leaf are just two examples of cars that now qualify for the full tax credit.

The Tax Benefits of Electric Vehicles

The SJC+0 Profit First Accountant takes a closer look at the many tax benefits associated with electric vehicles. From tax credits and rebates to depreciation and Section 179 deductions, there are plenty of ways to save money when buying or leasing an electric car. Taking advantage of these benefits can make electric vehicles an even more appealing choice for many consumers.

GM Wants Its $7,500 EV Tax Credit Back

While the US Federal Tax Credit program is a great incentive for purchasing an electric vehicle, it's not without controversy. In 2019, General Motors hit the cap on the number of cars eligible for the tax credit, leading to calls for a reform of the program. In 2021, GM announced that it's pushing for an extension of the tax credit, arguing that it would be an essential way to incentivize more consumers to buy electric cars.

Which Electric Vehicles Still Qualify for US Federal Tax Credit?

As new cars hit the market and existing models are updated, it can be tough to keep track of which vehicles still qualify for the US Federal Tax Credit. Fortunately, the Top Tech News blog has an up-to-date list of which cars are eligible for the full tax credit, and which ones have already hit the cap on the number of cars sold.

Overall, the US Federal Tax Credit program makes electric vehicles an attractive option for many consumers. With a variety of benefits and tax breaks available, now is a great time to make the switch to an electric car.

If you are searching about Electric Vehicles Qualifying For US Federal Tax Credit In 2021 you've visit to the right web. We have 8 Pics about Electric Vehicles Qualifying For US Federal Tax Credit In 2021 like Electric Vehicles Qualifying For US Federal Tax Credit In 2021, Electric Vehicles Qualifying For US Federal Tax Credit In 2021 and also The tax benefits of electric vehicles - SJC+0 Profit First Accountant. Here it is:

Electric Vehicles Qualifying For US Federal Tax Credit In 2021

www.austincartransport.com

www.austincartransport.com Electric Vehicles Tax Credit Program | Qualifying Vehicles | Bethesda CPA

www.cbmcpa.com

www.cbmcpa.com taxation individuals dealerships cpa

Electric Car Tax Credits: The Ultimate Guide | Freedom National

freedomgeneral.com

freedomgeneral.com The Tax Benefits Of Electric Vehicles - SJC+0 Profit First Accountant

www.sjcplus0.co.uk

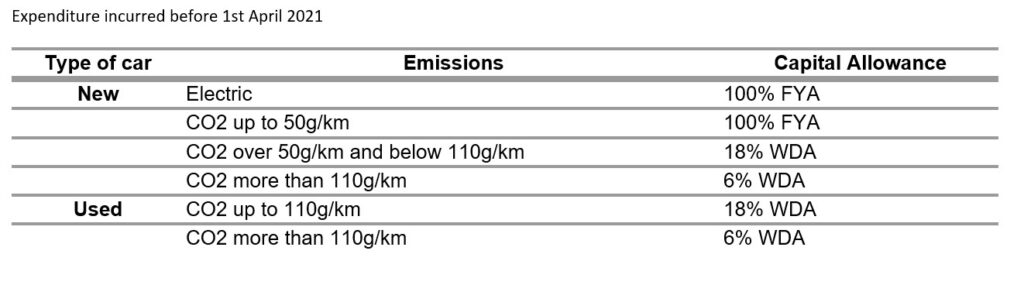

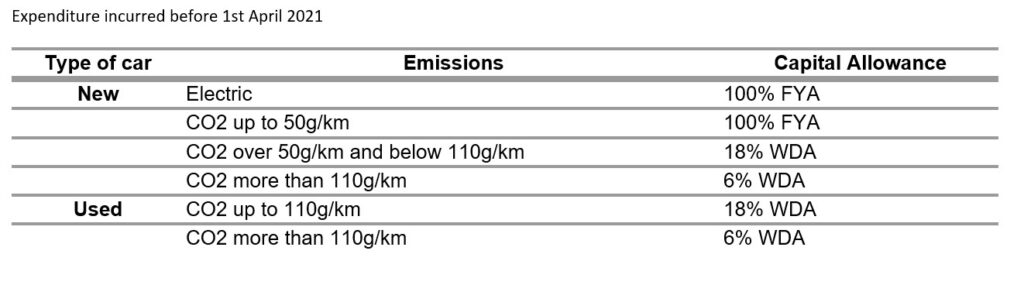

www.sjcplus0.co.uk summarised

Which Electric Vehicles Still Qualify For US Federal Tax Credit? - Top

toptech.news

toptech.news vehicles electric federal tax credit 2021 qualify still which entering surge qualifying prospective customers continue sales questions many

GM Wants Its $7,500 EV Tax Credit Back | The Drive

www.thedrive.com

www.thedrive.com euv chevy 2022 redesigned unveils elektroautos tax motor1 intros bangshift pressboltnews quattroruote autonomia aktuellste nachrichten hybride plug

Electric Vehicles Qualifying For US Federal Tax Credit In 2021

2021 tax vehicles electric credit qualifying federal millionaire maker surging mean comes does forward when year but worth

Electric Car Tax: The Benefits Of Electric Vehicles In 2021 | Raw

rawaccounting.co.uk

rawaccounting.co.uk 2021 tax vehicles electric credit qualifying federal millionaire maker surging mean comes does forward when year but worth. Electric vehicles tax credit program. Euv chevy 2022 redesigned unveils elektroautos tax motor1 intros bangshift pressboltnews quattroruote autonomia aktuellste nachrichten hybride plug

0 Comments