As the world moves towards a more sustainable future, many countries are encouraging the use of electric vehicles. The United States is no exception, and the Internal Revenue Service (IRS) offers tax credits for those who purchase qualified plug-in electric vehicles.

IRS Qualified Plug-in Vehicle List Updated

Recently, the IRS updated its list of qualified plug-in vehicles, adding several new models. The tax credit available for electric cars varies depending on the make and model, but it can range from $2,500 to $7,500. However, it's important to note that the tax credit is only available for a limited time. Once a certain number of units have been sold, the credit is phased out.

2021 Income Ranges for IRA and Saver's Credit Eligibility Announced

In addition to the plug-in vehicle tax credit, the IRS has also announced the income ranges for IRA and Saver's Credit eligibility for 2021. Individuals who earn below a certain income threshold may be eligible for tax credits, which can help them save for retirement. The income ranges for the Saver's Credit are adjusted each year to keep up with inflation.

Steps Outlined for the 2021 Tax Filing Season

The 2021 tax filing season began on February 12, and the IRS has outlined several steps to speed up the process. For example, taxpayers are encouraged to file their returns electronically and use direct deposit to receive their refunds. Additionally, the IRS has extended the deadline for making 2020 IRA contributions to May 17, 2021, to give taxpayers more time to save for retirement.

IRS Adds Hyundai Plug-In Electric Vehicles to Credit List

The IRS recently added several new Hyundai plug-in electric vehicles to its qualified plug-in vehicle list. This means that those who purchase these models may be eligible for the tax credit. The added incentive may encourage more people to make the switch to electric vehicles.

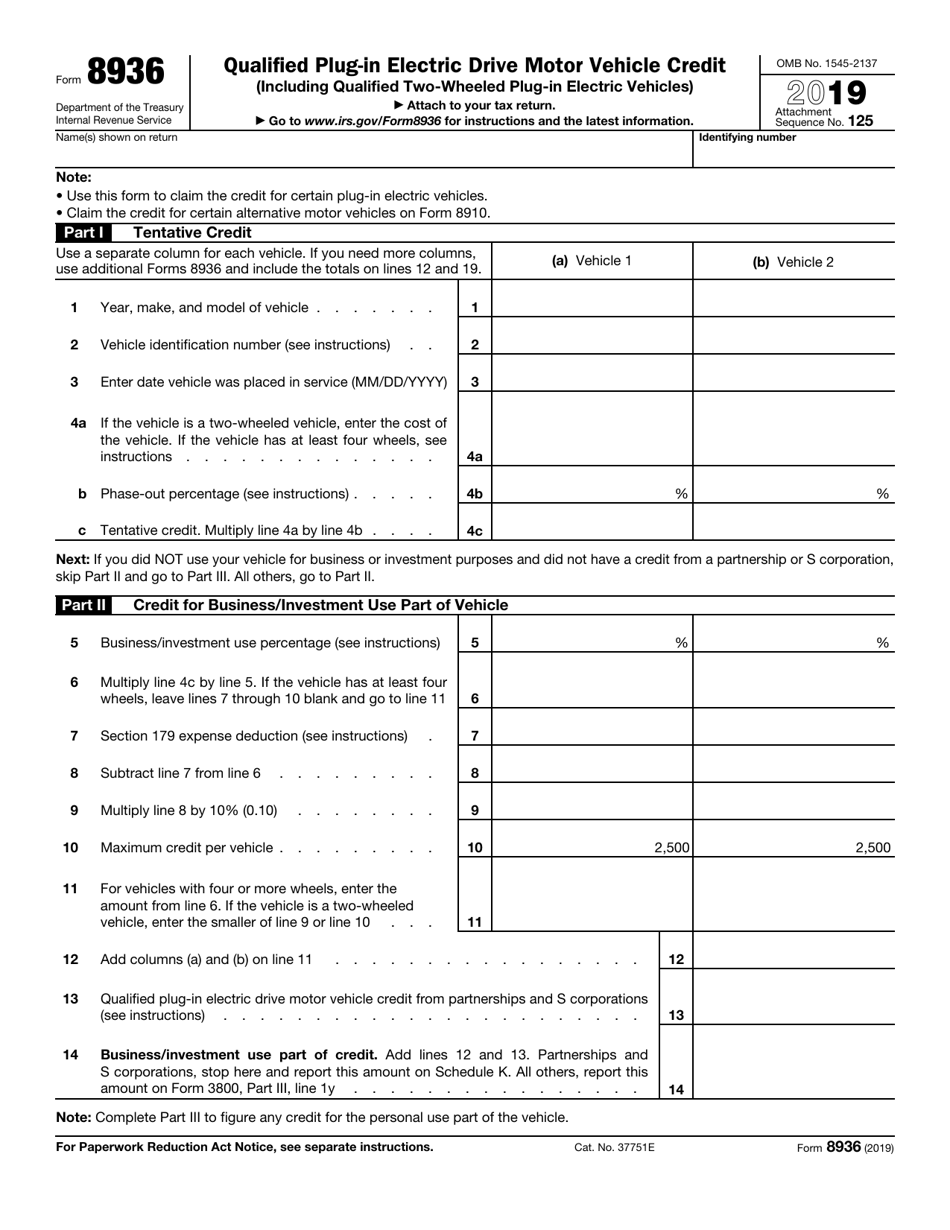

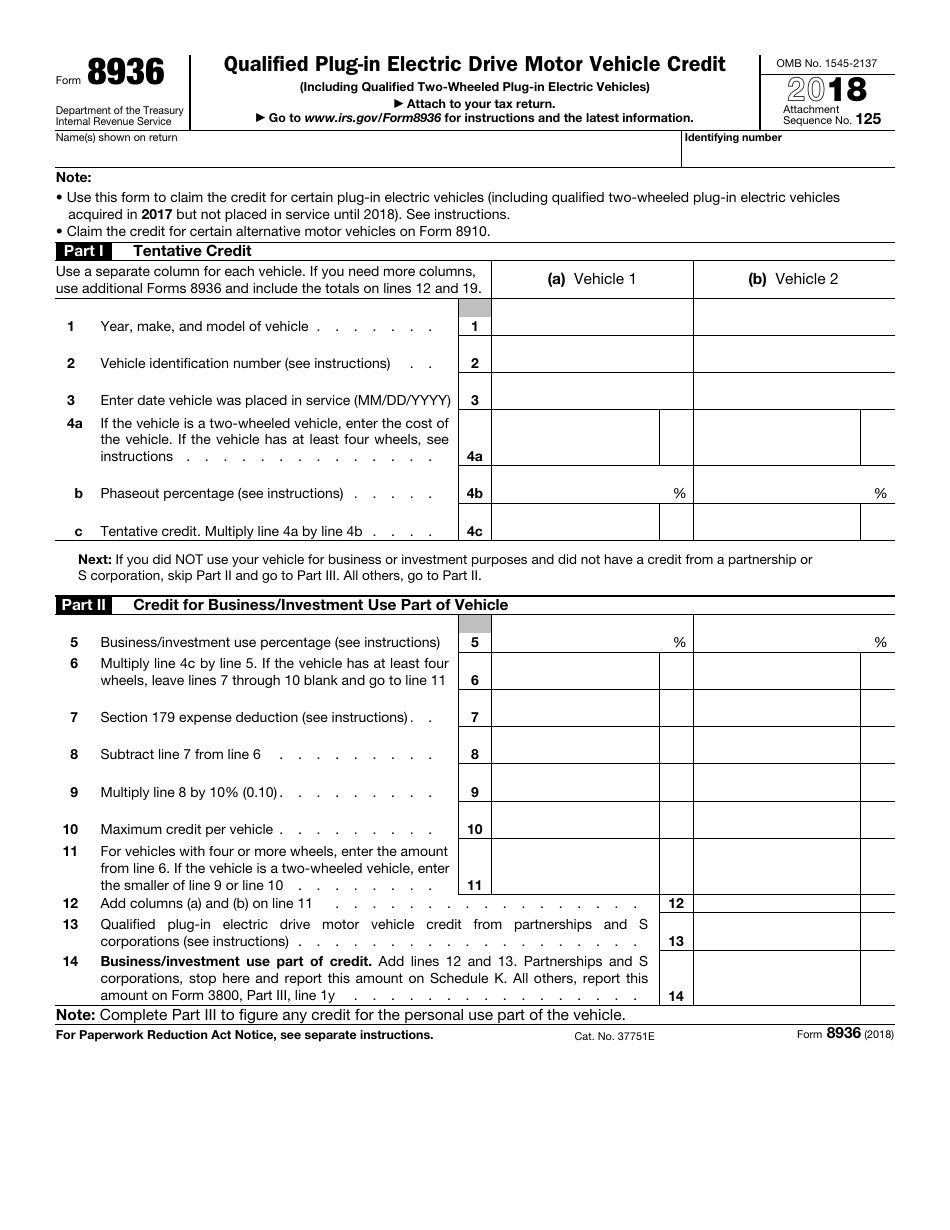

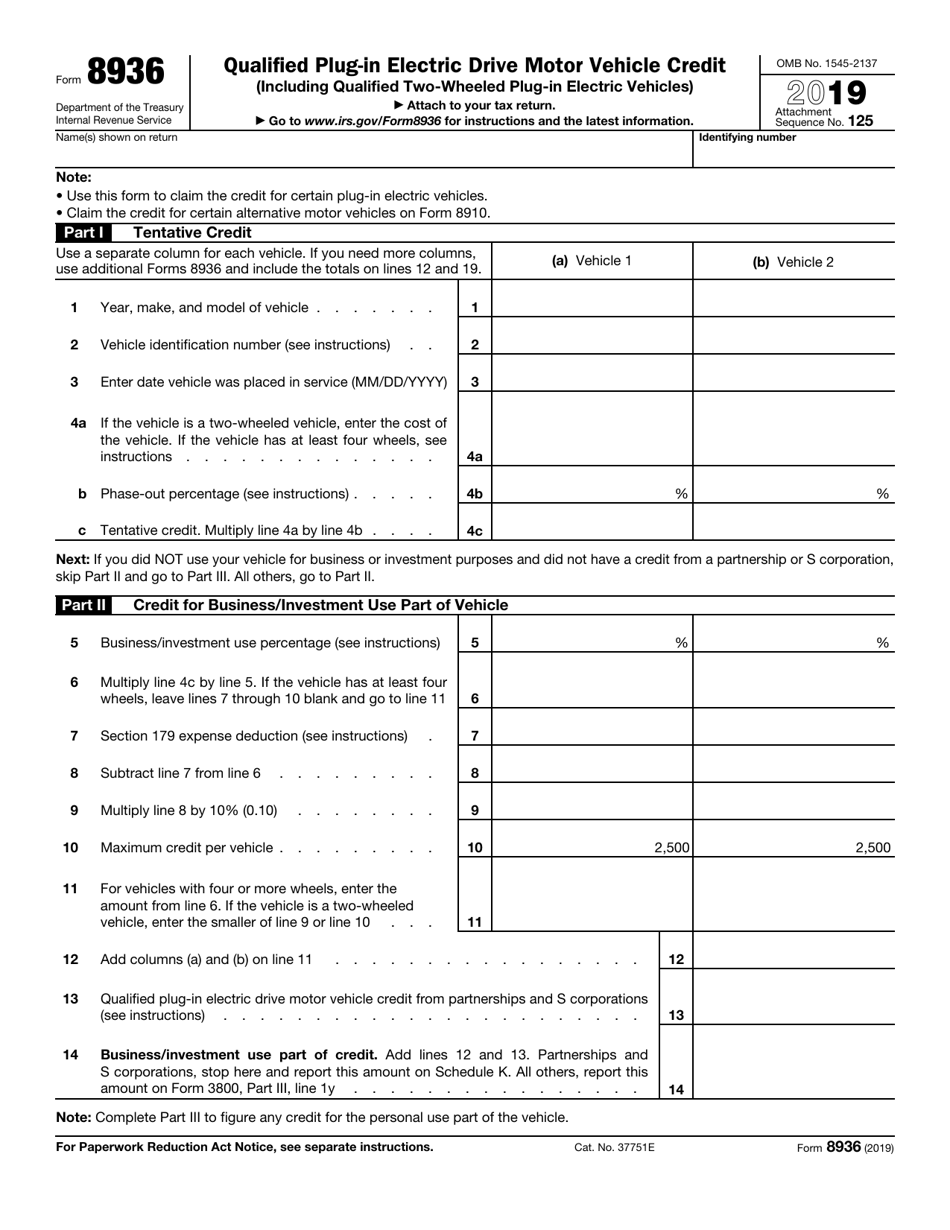

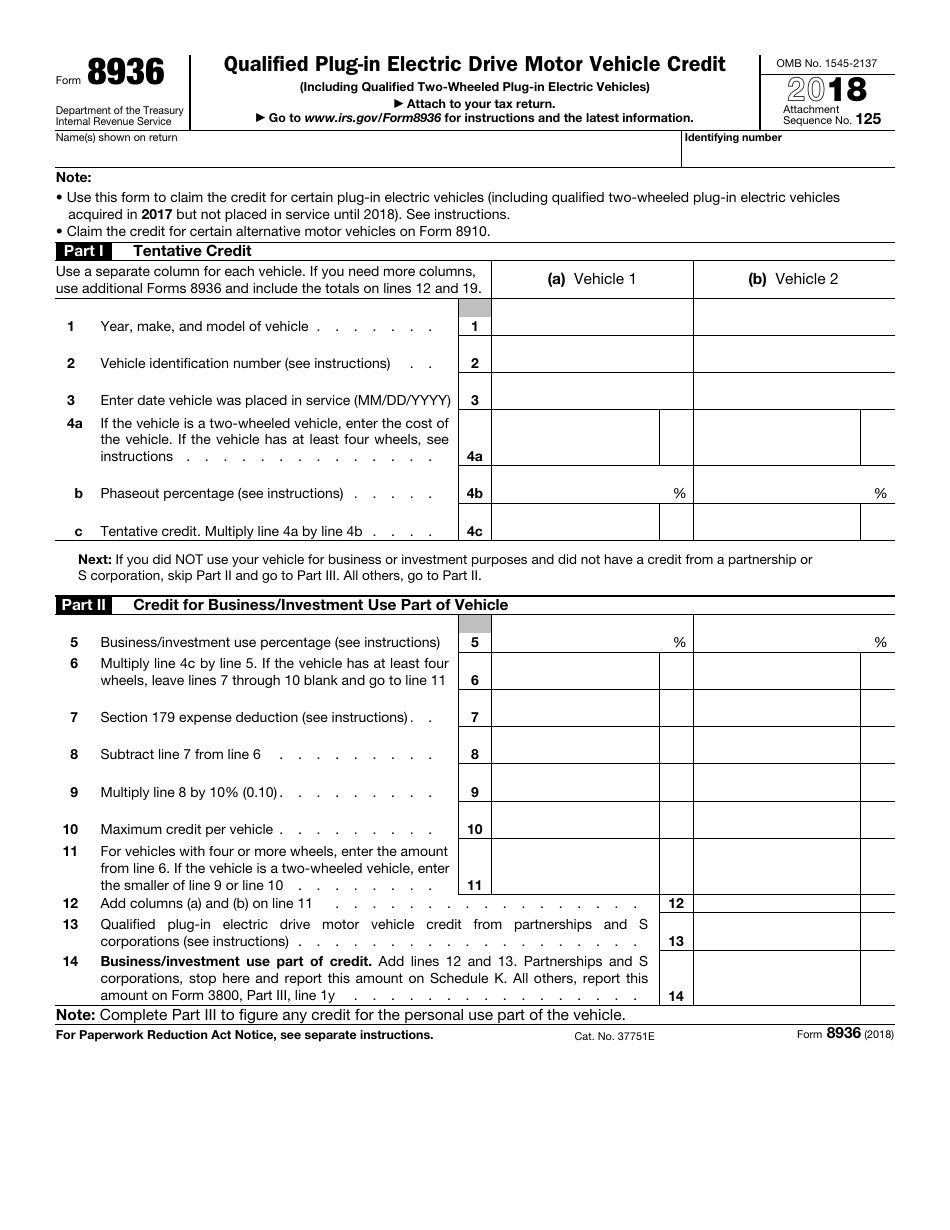

Download IRS Form 8936 for the Qualified Plug-In Electric Drive Motor Vehicle Credit

If you are purchasing a qualified plug-in electric vehicle, you will need to fill out IRS Form 8936 to claim the tax credit. The form can be downloaded and filled out online. Be sure to read the instructions carefully before submitting the form to the IRS.

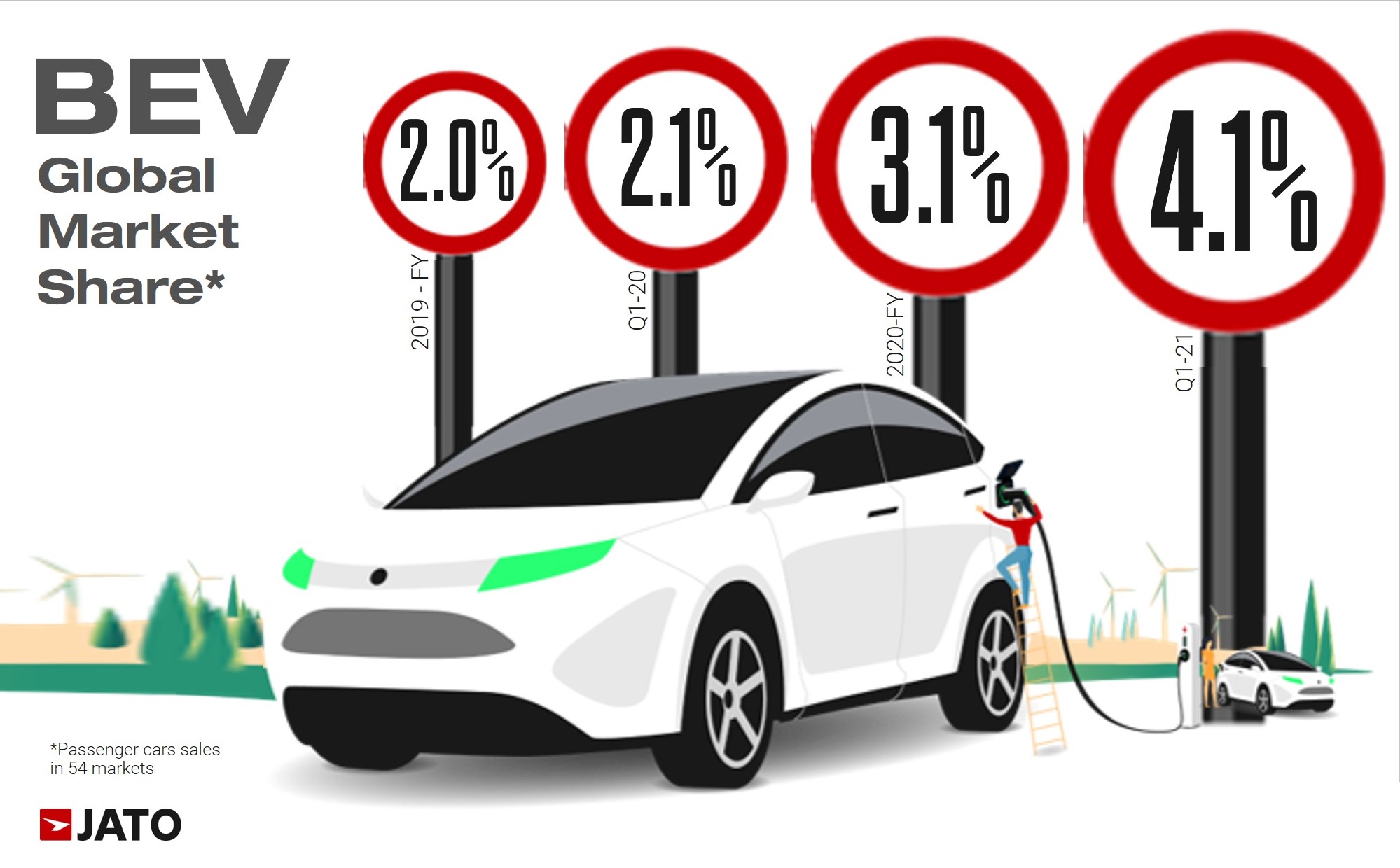

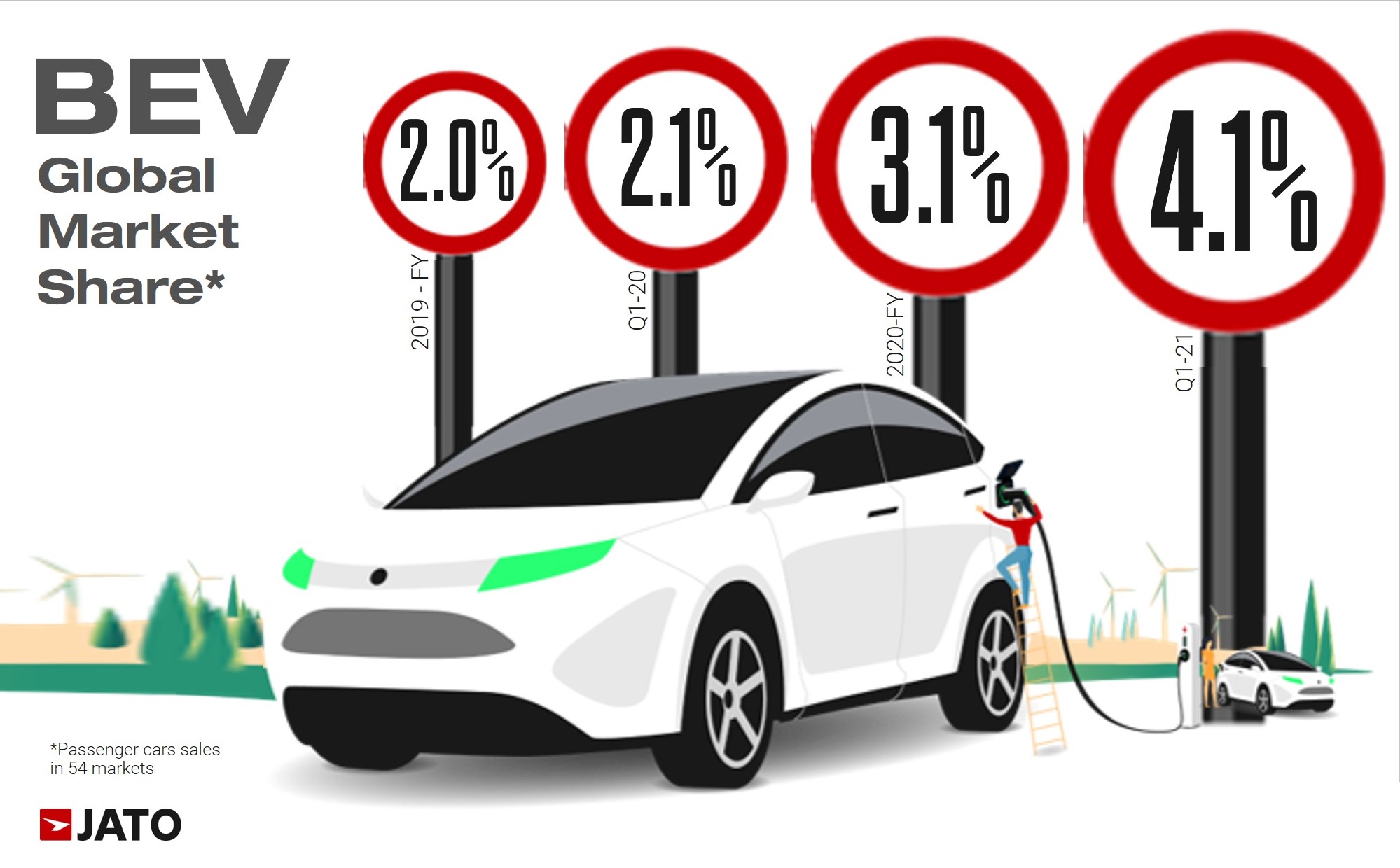

Global EV Sales Reach 2017 Full Year Figures in Q1 2021

Despite the challenges posed by the COVID-19 pandemic, global sales of electric vehicles have remained steady. In fact, in the first quarter of 2021, EV sales reached the same level as the entire year of 2017. This shows that there is a growing demand for electric vehicles around the world.

Child Tax Credit for 2021

The IRS also offers a child tax credit for eligible families. This credit can be claimed on Form 8812, which is included with Form 1040. For 2021, the child tax credit has been increased and is now fully refundable. This means that even families who don't owe any taxes can still receive the credit.

Download IRS Form 8936 for the Qualified Plug-In Electric Drive Motor Vehicle Credit

If you didn't claim the qualified plug-in electric drive motor vehicle credit in a previous tax year, it may be possible to amend your return and claim the credit. You can download IRS Form 8936 for the appropriate year and follow the instructions for amending your return.

Overall, the IRS offers several tax incentives to encourage the use of electric vehicles and retirement savings. By taking advantage of these credits and deductions, taxpayers can save money and help support a more sustainable future.

If you are looking for 2021 tax filing season begins Feb. 12; IRS outlines steps to speed you've came to the right page. We have 8 Pics about 2021 tax filing season begins Feb. 12; IRS outlines steps to speed like Q1 2021 EV global sales at the same level as 2017 full year figures - JATO, IRS Adds Vehicles to Qualified Plug-in Vehicle List | Haynie & Company and also IRS Adds Vehicles to Qualified Plug-in Vehicle List | Haynie & Company. Here you go:

2021 Tax Filing Season Begins Feb. 12; IRS Outlines Steps To Speed

prescottenews.com

prescottenews.com irs refunds

IRS Announces 2021 Income Ranges For IRA, Saver’s Credit Eligibility

katestax.com

katestax.com irs eligibility ira

Irs Child Tax Credit 2021 Form | Cahunit.com

cahunit.com

cahunit.com form irs 1040 templateroller fillable

Q1 2021 EV Global Sales At The Same Level As 2017 Full Year Figures - JATO

www.jato.com

www.jato.com jato

IRS Adds Hyundai Plug-In Electric Vehicles To Credit List - Windes

irs hyundai eworld windes

IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug-In

www.templateroller.com

www.templateroller.com irs plug qualified templateroller motor

IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug-In

www.templateroller.com

www.templateroller.com irs qualified templateroller

IRS Adds Vehicles To Qualified Plug-in Vehicle List | Haynie & Company

www.hayniecpas.com

www.hayniecpas.com irs qualified jacobson nan

Irs eligibility ira. Irs qualified jacobson nan. Irs form 8936 download fillable pdf or fill online qualified plug-in

0 Comments