If you're considering purchasing an electric vehicle, one thing you should be aware of is the federal tax credit that can help offset some of the cost. In this post, we'll walk you through how to claim the tax credit, explain how the amount is calculated, and provide some additional resources to help you along the way.

Step-by-Step Guide to Claiming the Tax Credit

The first thing you need to know is that in order to claim the tax credit, you must have purchased a new electric vehicle during the 2018-2020 tax years (that means between January 1, 2018 and December 31, 2020). Additionally, the vehicle must meet certain criteria, such as having a battery capacity of at least 4 kWh and being primarily powered by an electric motor. You can find a list of eligible vehicles on the IRS website.

Assuming you meet these criteria, here's what you need to do to claim the tax credit:

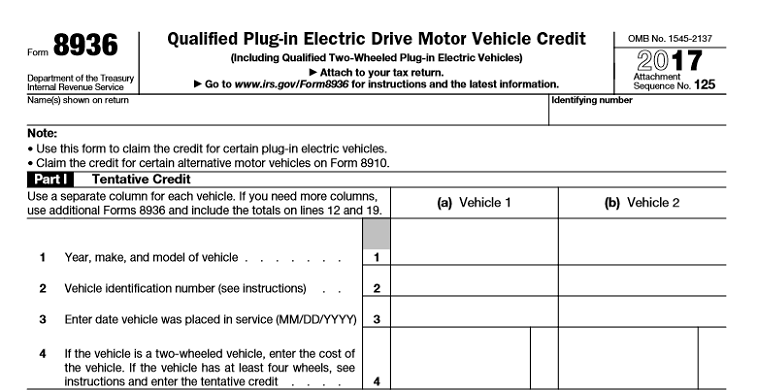

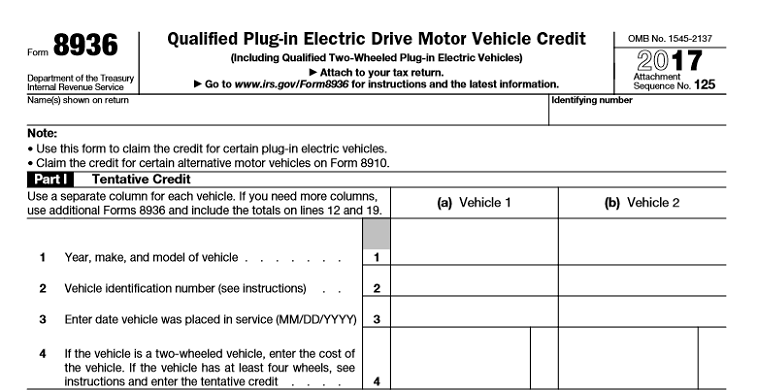

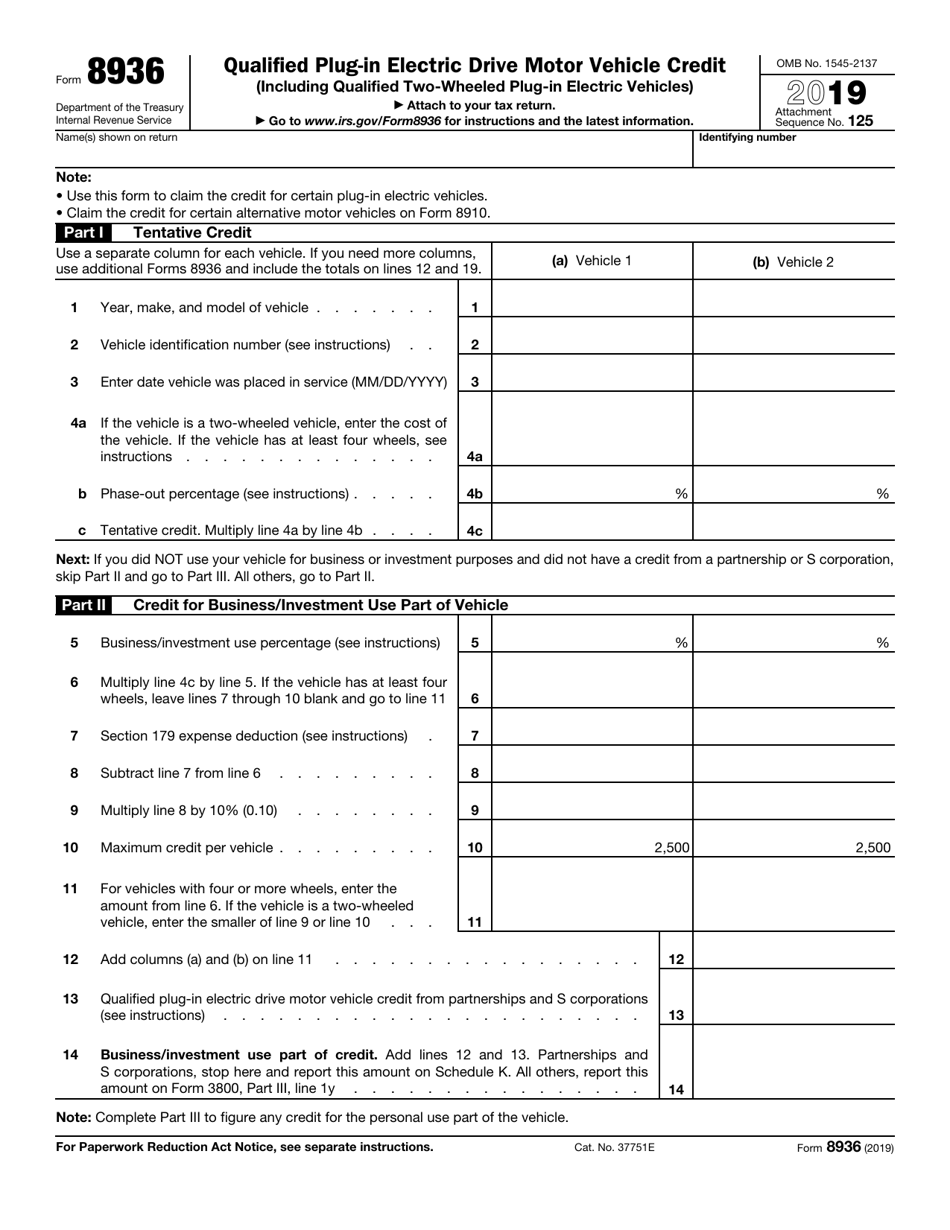

- Fill out IRS Form 8936, which is the Qualified Plug-In Electric Drive Motor Vehicle Credit form. You'll need to provide some basic information about the vehicle, such as the make and model, the date it was acquired, and the amount of the credit you're claiming.

- Figure out how much of the credit you're actually eligible for. The credit is worth up to $7,500, but the exact amount will depend on the battery capacity of the vehicle and the manufacturer. You can use resources like the one from EVAdoption to help you calculate the credit.

- Fill out the relevant sections of your tax return (specifically, Form 1040) to claim the credit. You'll need to include Form 8936 with your return, as well as any other supporting documentation that's required (such as proof of purchase).

- Submit your tax return by the appropriate deadline (usually April 15th). You should receive a credit applied against your taxes owed of the amount that you are eligible for.

How the Credit Amount is Calculated

As mentioned above, the exact amount of the credit will depend on a few different factors. Here's a quick summary of how it works:

- The credit is worth up to $7,500, but it's important to note that not all vehicles qualify for the full amount.

- The credit starts to phase out once a manufacturer has sold a certain number of electric vehicles (EVs). For example, once a manufacturer has sold 200,000 EVs in the US, the credit amount for that manufacturer's vehicles starts to decrease.

- The credit amount also varies based on the battery capacity of the vehicle. Vehicles with larger battery capacities generally qualify for a higher credit amount.

Overall, the federal EV tax credit can be a great way to save some money when purchasing an electric vehicle. Just be sure to do your research ahead of time to ensure you meet all the eligibility requirements and understand how the credit amount is calculated.

Additional Resources

If you're still looking for more information about the federal EV tax credit, here are a few additional resources that may be helpful:

- ChargePoint's guide to claiming the tax credit for home charging

- The IRS website's overview of Form 8936 and the credit

- A PDF of Form 8936 that you can download and fill out

Get the Most Out of Your Electric Vehicle Purchase

If you're considering purchasing an electric vehicle, don't forget to take advantage of the federal tax credit. With a little bit of planning and preparation, you can claim the credit and save some money on your new ride. As always, be sure to shop around and do your due diligence to ensure you're getting the best deal possible. Happy driving!

How to Claim the Tax Credit for Home Charging

In addition to the federal tax credit for electric vehicles, there's also a tax credit available for installing a home charging station. Here's what you need to know:

- The credit is worth up to 30% of the cost of the charging station, up to a maximum of $1,000.

- You can claim the credit on your tax return for the year in which the charging station was installed.

- The charging station must meet certain criteria in order to be eligible for the credit. For example, it must be installed at your primary residence, and it must be able to charge an electric vehicle using a plug that meets industry standards.

If you're interested in claiming the tax credit for a home charging station, consult with your tax professional to ensure that you meet all the eligibility requirements and are able to claim the credit correctly.

Reinstatement of the Tax Credit for 2018-2020 EV Purchases and Chargers

If you missed out on claiming the federal tax credit for your electric vehicle purchase or home charging station installation in past years, you may be in luck. In December 2019, the tax credit was reinstated for certain purchases made in 2018, 2019, and even 2020 (the credit had previously expired at the end of 2017).

If you made a qualifying purchase during this time period, you may still be able to claim the credit when you file your tax return. Just be sure to consult with your tax professional to ensure that you're doing everything correctly and taking advantage of all available tax credits and deductions.

Additions to the Qualified Plug-in Vehicle List

Another recent development in the world of electric vehicle tax credits is the addition of several new vehicles to the qualified plug-in vehicle list. This list is maintained by the IRS and includes all vehicles that are eligible for the tax credit. Here are a few of the most notable additions:

- 2021 Audi e-Tron

- 2021 Ford Mustang Mach-E

- 2021 Polestar 2

If you're considering purchasing one of these models (or any other electric vehicle), be sure to check the IRS website to ensure that it's eligible for the tax credit.

Reporting Discrepancies Remain for Electric Car Purchase Tax Credits

Finally, it's worth noting that there are still some reporting discrepancies when it comes to electric car purchase tax credits. Specifically, some car dealerships have been accused of misleading customers about the size of the tax credit they're eligible for, or even falsifying documents altogether.

If you're purchasing an electric vehicle and plan to claim the tax credit, be sure to do your own research and make sure you understand exactly how much you're eligible for. Don't rely solely on what a dealership tells you. And if you suspect any fraudulent activity, don't hesitate to report it to the appropriate authorities.

In conclusion, the federal tax credit for electric vehicles and home charging stations can be a great way to save money on your purchase and installation. Just be sure to do your research and follow the proper steps to ensure that you're eligible for the credit and claiming it correctly. And remember, if you have any questions or need additional guidance, there are plenty of resources available to help you along the way.

If you are searching about Claiming the $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide you've visit to the right page. We have 8 Pics about Claiming the $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide like IRS Adds Vehicles to Qualified Plug-in Vehicle List | Haynie & Company, IRS Form 8936 Download Fillable PDF or Fill Online Qualified Plug-In and also How to Claim Your Federal Tax Credit for Home Charging | ChargePoint. Here you go:

Claiming The $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide

www.cheatsheet.com

www.cheatsheet.com irs claiming forms cheatsheet

How To Claim Your Federal Tax Credit For Home Charging | ChargePoint

tax credit federal chargepoint

IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug-In

www.templateroller.com

www.templateroller.com irs plug qualified templateroller motor

Federal Tax Credit Reinstated For 2018-2020 EV Purchases And Chargers

ev4corners.org

ev4corners.org IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug-In

www.templateroller.com

www.templateroller.com irs qualified vehicle templateroller

IRS Electric-Car Tax Credits: Reporting Discrepancies Remain

www.greencarreports.com

www.greencarreports.com irs discrepancies remain qualifying

How The Federal EV Tax Credit Amount Is Calculated For Each EV | EVAdoption

evadoption.com

evadoption.com federal calculated evadoption

IRS Adds Vehicles To Qualified Plug-in Vehicle List | Haynie & Company

www.hayniecpas.com

www.hayniecpas.com irs qualified jacobson nan

Irs adds vehicles to qualified plug-in vehicle list. Irs form 8936 download fillable pdf or fill online qualified plug-in. Federal calculated evadoption

0 Comments