If you're thinking about purchasing an electric vehicle, you may be wondering about the electric vehicle tax credit. This credit is a federal tax credit that can help offset the cost of buying an electric vehicle.

The Basics: What is the Electric Vehicle Tax Credit?

The electric vehicle tax credit is a credit that can be applied to your federal taxes if you purchase an electric vehicle. The credit is a one-time credit and is based on the capacity of the vehicle's battery. The maximum credit amount is $7,500.

The credit is designed to encourage people to purchase electric vehicles as a way to help reduce greenhouse gas emissions and improve air quality.

Who Qualifies for the Electric Vehicle Tax Credit?

To qualify for the electric vehicle tax credit, you must:

- Be the original purchaser of a new electric vehicle

- Have a tax liability equal to or greater than the amount of the credit

- Not have reached the sales limit for the manufacturer of the electric vehicle

The amount of the credit is based on the capacity of the vehicle's battery and begins to phase out after the manufacturer sells a certain number of electric vehicles in a year. Once a manufacturer hits the sales limit, the credit begins to phase out over the following year before being completely phased out.

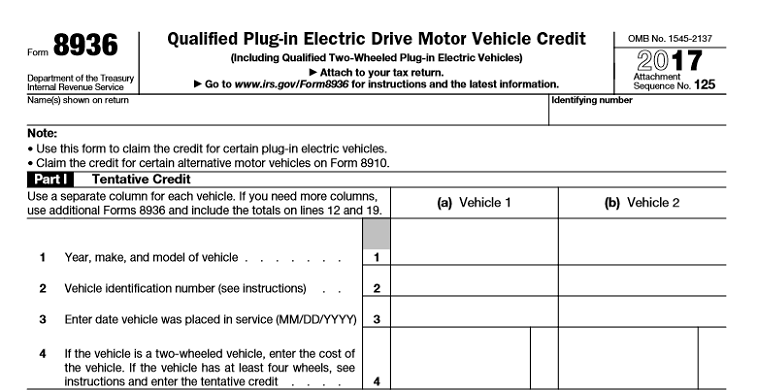

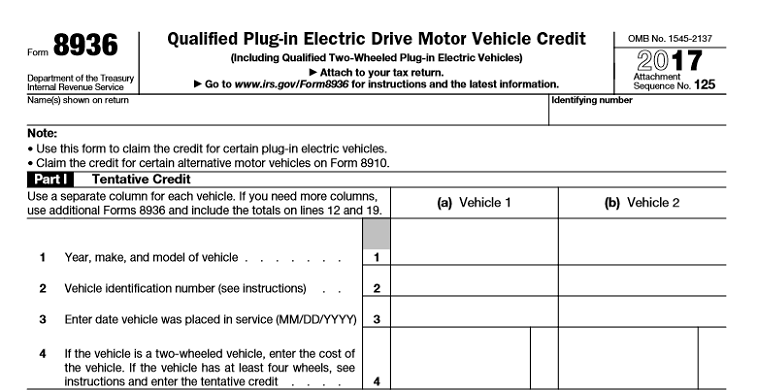

How to Claim the Electric Vehicle Tax Credit

Claiming the electric vehicle tax credit is a relatively simple process. When you file your federal taxes, you will need to fill out Form 8936 to claim the credit. You will need to provide documentation to show that you are the original purchaser of the electric vehicle and the date of purchase.

If you have a tax liability that is less than the full amount of the credit, you may be able to carry the remaining credit forward to future tax years.

Electric Vehicle Tax Credit Frequently Asked Questions

When does the electric vehicle tax credit expire?

The electric vehicle tax credit does not have a set expiration date. However, the credit begins to phase out once a manufacturer sells 200,000 electric vehicles. For example, Tesla hit the 200,000 sales mark in 2018, so the credit began to phase out for Tesla vehicles sold after December 31, 2018.

Can the electric vehicle tax credit be used for used electric vehicles?

No, the electric vehicle tax credit can only be applied to the purchase of a new electric vehicle.

Is the electric vehicle tax credit refundable?

The electric vehicle tax credit is not refundable. If your tax liability is less than the amount of the credit, you may be able to carry the remaining credit forward to future tax years.

Can the electric vehicle tax credit be used for plug-in hybrid vehicles?

Yes, the electric vehicle tax credit can be applied to some plug-in hybrid vehicles. The credit amount is based on the battery capacity of the vehicle. If the battery capacity is less than 5 kilowatt-hours, the vehicle does not qualify for the credit. If the battery capacity is between 5 and 16 kilowatt-hours, the vehicle is eligible for a partial credit. If the battery capacity is greater than 16 kilowatt-hours, the vehicle is eligible for the full credit.

State Electric Vehicle Incentives

In addition to the federal electric vehicle tax credit, there are also state-level incentives that can help make purchasing an electric vehicle more affordable. These incentives vary by state but can include tax credits, rebates, and reduced registration fees.

California Electric Vehicle Incentives

California is one of the most electric vehicle-friendly states in the country and offers a number of incentives to encourage its residents to buy electric vehicles. These incentives include:

- A purchase rebate of up to $2,000 for new electric vehicles and up to $1,000 for used electric vehicles

- A Clean Vehicle Rebate Project, which offers rebates for the purchase or lease of new electric vehicles

- The High Occupancy Vehicle (HOV) Lane Access program, which allows electric vehicle drivers to use the HOV lane without meeting the minimum occupancy requirement

Other State Electric Vehicle Incentives

Other states also offer incentives for purchasing electric vehicles. Some examples include:

- Colorado: A tax credit of up to $5,000 for the purchase of a new electric vehicle

- New York: A rebate of up to $2,000 for the purchase of a new electric vehicle

- Oregon: A rebate of up to $2,500 for the purchase or lease of a new electric vehicle

Electric Vehicle Tax Credit: Pros and Cons

Pros of the Electric Vehicle Tax Credit

- Reduces the cost of purchasing an electric vehicle

- Encourages people to make the switch to electric vehicles, which can help reduce greenhouse gas emissions and improve air quality

Cons of the Electric Vehicle Tax Credit

- Only applies to new electric vehicles

- The credit begins to phase out once a manufacturer reaches a certain sales threshold, which can make the credit less valuable for some people

- The credit is not refundable

The Bottom Line

The electric vehicle tax credit is a federal tax credit that can help offset the cost of purchasing an electric vehicle. While the credit only applies to new electric vehicles, there are also state-level incentives that can make purchasing an electric vehicle more affordable. If you're thinking about purchasing an electric vehicle, be sure to do your research and take advantage of any available incentives to help make the switch to electric more affordable.

References

- Electric Vehicles Tax Credits and Other Incentives

- Federal Tax Credits for All-Electric and Plug-in Hybrid Vehicles

- Clean Vehicle Rebate Project

- HOV Lane Access

- Colorado Electric Vehicle Tax Credit

- New York State Drive Clean Rebate

- Alternative Fuel Vehicle Rebate Program

If you are looking for Electric Vehicle Tax Credit: What to Know for 2020 – Action News Jax you've visit to the right web. We have 8 Pics about Electric Vehicle Tax Credit: What to Know for 2020 – Action News Jax like Electric Vehicle Tax Credits: What You Need to Know - Doty Pruett and, ev tax credit 2022 california - So Great Microblog Picture Gallery and also Electric vehicle tax credit survives in latest tax bill, but phase out. Here it is:

Electric Vehicle Tax Credit: What To Know For 2020 – Action News Jax

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) www.actionnewsjax.com

www.actionnewsjax.com calculate

Electric Vehicle Tax Credit Survives In Latest Tax Bill, But Phase Out

www.freep.com

www.freep.com bolt zippy mainstream ev survives incentives congressional conferees dropped wipe

Virginia Electric Vehicle Tax Credit 2022 - This Greatest Weblogs

kyla52581.blogspot.com

kyla52581.blogspot.com Electric Vehicle Tax Credit 2022 - Solar Titan USA

solartitanusa.com

solartitanusa.com Electric Vehicle Tax Credit Update For New Models | Fuoco Group

www.fuoco.cpa

www.fuoco.cpa kaplan

Electric Vehicle Tax Credits: What You Need To Know - Doty Pruett And

dpwcpas.com

dpwcpas.com ev electrek money qualify

Claiming The $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide

www.cheatsheet.com

www.cheatsheet.com irs claiming forms cheatsheet

Ev Tax Credit 2022 California - So Great Microblog Picture Gallery

book-marketing456.blogspot.com

book-marketing456.blogspot.com Electric vehicle tax credit update for new models. Virginia electric vehicle tax credit 2022. Electric vehicle tax credit: what to know for 2020 – action news jax

0 Comments