Have you ever thought about owning an electric car? Not only are they environmentally friendly, but they can also provide a range of financial benefits, including a tax credit for purchasing one. Let's take a closer look at what the electric car tax credit is and how it can benefit drivers of all income levels.

What is the Electric Car Tax Credit?

The electric car tax credit is a federal tax credit that provides a financial incentive to people who buy qualifying electric vehicles. The credit can offset the cost of the vehicle significantly, making it more affordable for consumers to purchase an electric car.

The credit is only available for a limited time, as the government sets a specific cap on how many credits it will offer. Once that cap is reached, the credit will no longer be available. Therefore, it's important to take advantage of the credit while it's still available.

How Does the Electric Car Tax Credit Work?

The electric car tax credit works by reducing the amount of federal income tax you owe. The credit is non-refundable, meaning you can only use it to offset the amount of federal income tax you owe in a given year. If you don't owe any federal income tax, you won't be able to take advantage of the credit.

To qualify for the credit, you must purchase a qualified electric vehicle. The credit amount depends on the make and model of the vehicle and the battery size. Generally, the larger the battery, the higher the credit amount.

Who Qualifies for the Electric Car Tax Credit?

Not everyone who purchases an electric car will qualify for the tax credit. To qualify, you must meet the following criteria:

- You must purchase the vehicle for personal use, not for business.

- You must be the original owner of the vehicle.

- The vehicle must be new, not used.

- The vehicle must meet certain battery capacity requirements. Cars with larger batteries generally qualify for a higher credit amount.

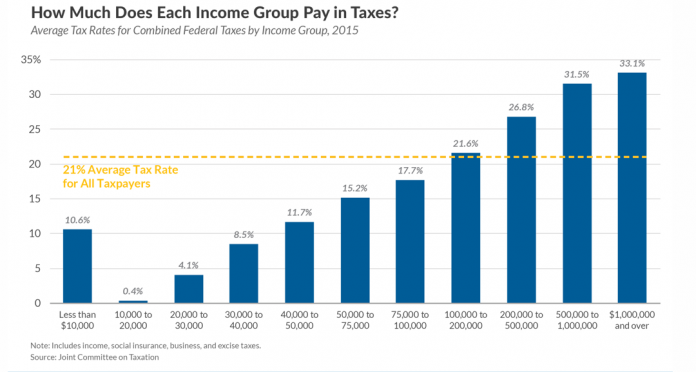

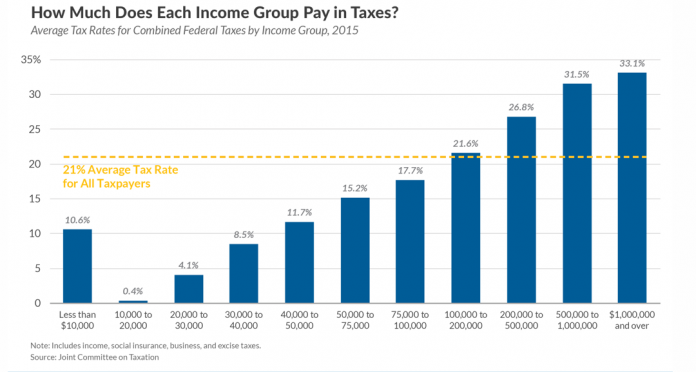

- Your income must be below a certain threshold. The credit begins to phase out for individuals with adjusted gross incomes over $50,000 and married couples filing jointly with incomes over $100,000.

If you meet these criteria, you may be eligible for a tax credit of up to $7,500.

Why Should You Consider an Electric Car?

If you're still on the fence about purchasing an electric car, here are some reasons why you should consider it:

- Environmental Benefits: Electric cars produce zero emissions, which means they're much better for the environment than traditional gasoline-powered vehicles.

- Lower Operating Costs: Electric cars have lower operating costs than gas-powered vehicles because they require less maintenance and have lower fuel costs.

- Long-Term Savings: While electric cars may cost more upfront, they can save you money in the long run because of their lower operating costs and the tax credit.

- Convenience: With more charging stations popping up around the country, driving an electric car is becoming more convenient than ever before.

- Tech-Savvy: Many electric cars come equipped with the latest technology, making them a fun and enjoyable driving experience.

What You Need to Know Before Purchasing an Electric Car

Before you purchase an electric car, it's essential to do your research to ensure you're making the right decision for your needs. Here are a few things to consider:

- Cost: Electric cars can be more expensive upfront than traditional cars. However, the tax credit can offset some of the costs, making it more affordable.

- Range: Electric cars have a limited range, so it's important to make sure that the car you're considering can meet your daily driving needs.

- Charging Time: Charging an electric car can take longer than filling up a traditional car with gas. Therefore, it's important to plan accordingly and make sure you have access to charging stations.

- Home Charging: If you plan on owning an electric car, you'll likely need to install a home charging station, which can be an additional cost.

- Use Tax Credits Wisely: If you do decide to purchase an electric car, make sure you use the tax credit wisely to maximize your savings.

Take Advantage of the Electric Car Tax Credit Today

If you're considering purchasing an electric car, now is the time to take advantage of the federal tax credit. Not only can it save you money upfront, but it can also provide long-term financial benefits. Plus, you'll be doing your part to help the environment by driving an electric car.

So, what are you waiting for? Head to your local dealership and take a test drive of an electric car today to see if it's the right choice for you.

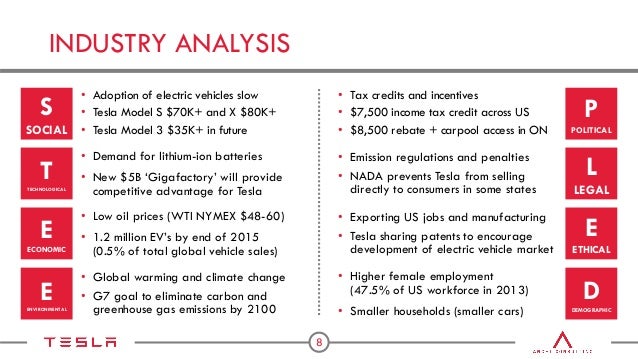

The Future of Electric Cars

The electric car industry is rapidly growing, with more and more automakers releasing electric models each year. As the technology continues to advance, electric cars will become more affordable, practical, and accessible to consumers of all income levels.

In addition to the tax credit, some states also offer incentives for electric car owners, such as access to HOV lanes and free parking in certain areas. These incentives, combined with the tax credit, can make owning an electric car even more appealing for consumers.

Overall, the electric car tax credit provides a compelling reason to consider purchasing an electric car. Not only can you save money upfront, but you'll also enjoy long-term financial benefits and the satisfaction of doing your part to help the environment.

If you are searching about Tax Credit For Electric Vehicle - TaxProAdvice.com you've came to the right place. We have 8 Pictures about Tax Credit For Electric Vehicle - TaxProAdvice.com like How Does Tesla Tax Credit Work - Electric Car Tax Credit 2021, Tax Credit For Electric Vehicle - TaxProAdvice.com and also Electric vehicle: The power of the tax credit for buying - Hare CPAs. Here it is:

Tax Credit For Electric Vehicle - TaxProAdvice.com

www.taxproadvice.com

www.taxproadvice.com Electric Vehicle: The Power Of The Tax Credit For Buying - Hare CPAs

harecpas.com

harecpas.com How Does Tesla Tax Credit Work - Electric Car Tax Credit 2021

www.vehiclesuggest.com

www.vehiclesuggest.com vehiclesuggest taxfoundation

EV Tax Credit: A Comprehensive Guide

tax electric car income federal credit year comprehensive guide taxable liability changed significantly between if

Tesla Motors Presentation

www.slideshare.net

www.slideshare.net Federal Tax Credit For Electric Cars 2021 Reddit : Tesla Gm Could Crush

lauraslebendarling.blogspot.com

lauraslebendarling.blogspot.com tax redd qualify

Update: Income Tax Payments Deferred To July 15, Regardless Of Amount

kerberrose.com

kerberrose.com The Electric Car Tax Credit Benefits Drivers Of All Income Levels

www.kochvsclean.com

www.kochvsclean.com income

Federal tax credit for electric cars 2021 reddit : tesla gm could crush. The electric car tax credit benefits drivers of all income levels. Ev tax credit: a comprehensive guide

0 Comments