The world is changing, and it's changing fast. As we face the daunting reality of climate change, we must make changes that will help to mitigate the damage. One such change is the move toward electric vehicles, and the IRS is making it easier for consumers to make that switch by offering tax credits for qualifying plug-in electric drive motor vehicles.

What is the IRS Tax Credit for Qualified Plug-In Electric Drive Motor Vehicles?

The IRS offers a tax credit for the purchase of new, qualifying, plug-in electric drive motor vehicles. The credit is based on the vehicle's battery capacity, and it can range from $2,500 to $7,500. To be eligible for the credit, the vehicle must be new and have a battery that is capable of being charged from an external source and that has a capacity of at least 4 kWh.

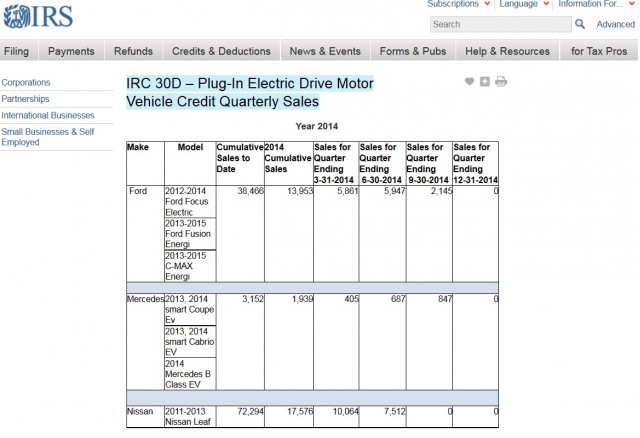

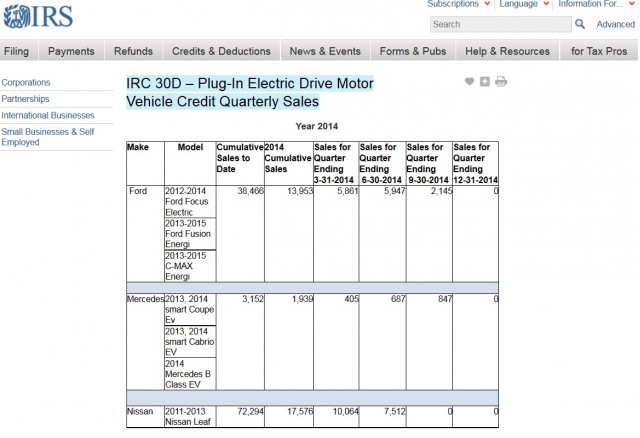

The credit is phased out after each manufacturer sells (or leases) 200,000 eligible vehicles in the United States. Currently, General Motors and Tesla have exceeded the 200,000 sales mark, and their vehicles are no longer eligible for the credit. However, other manufacturers, such as Ford, Honda, and Toyota, still have eligible models.

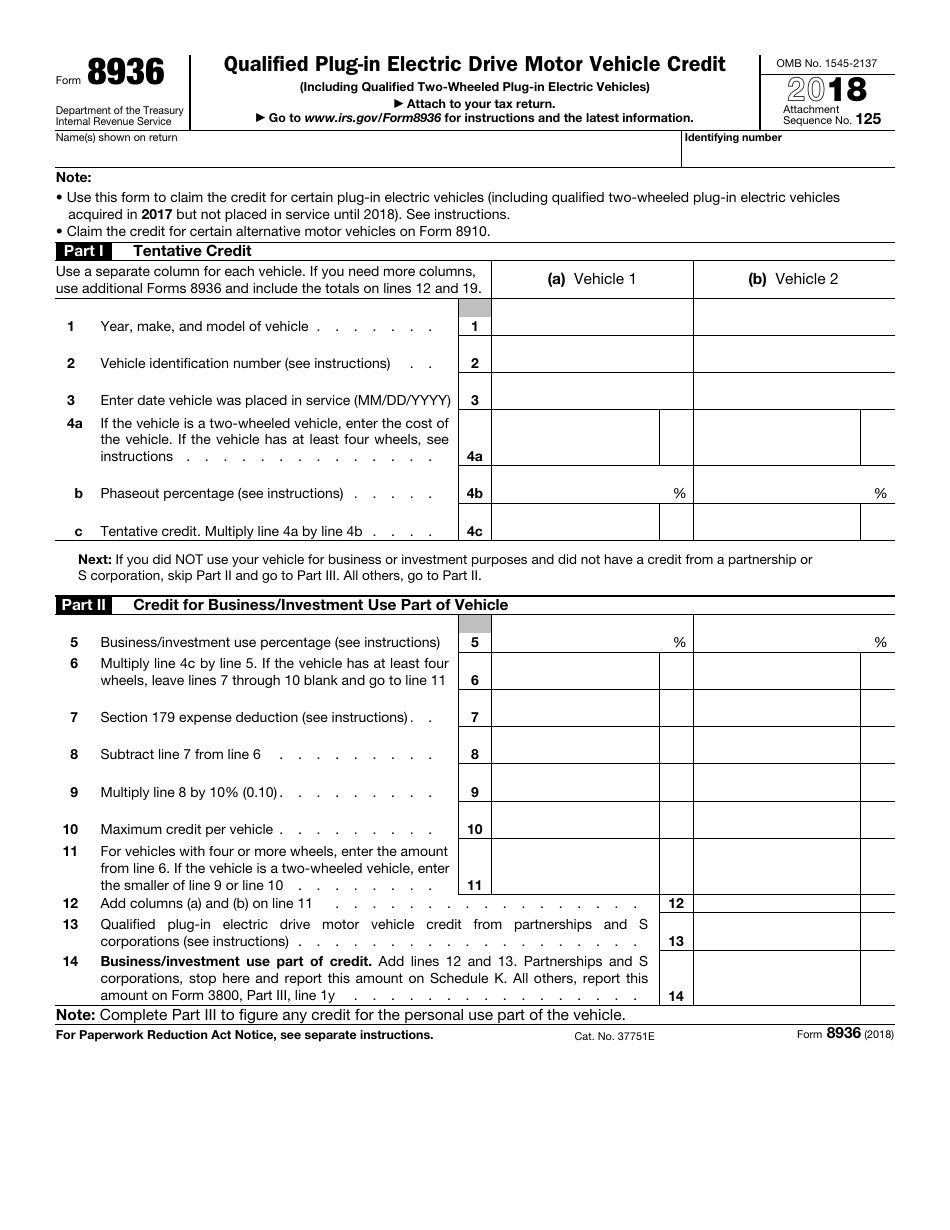

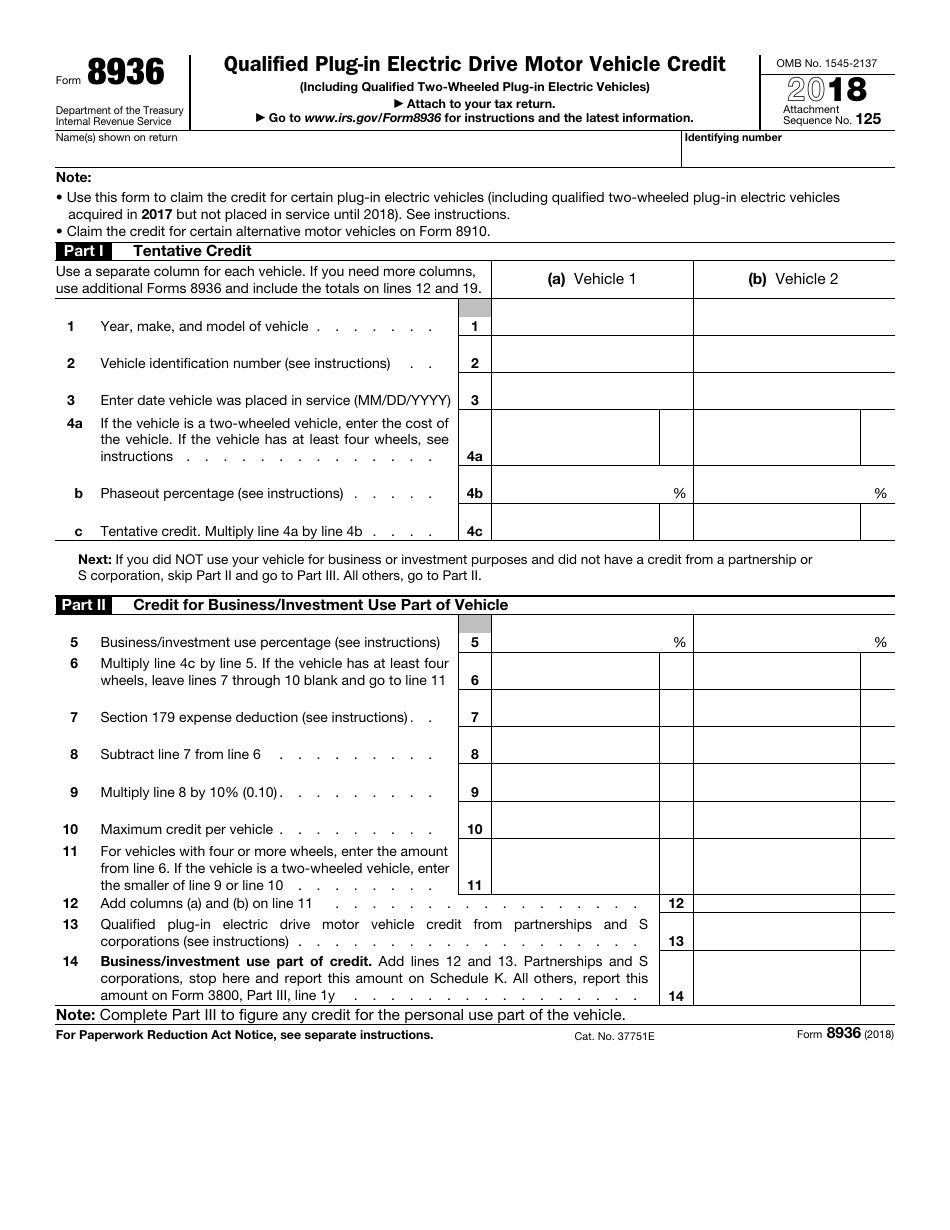

How to Claim the Credit

To claim the credit, you must fill out IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit. The credit is applied to your tax liability, which means that if you owe taxes, the credit can reduce the amount you owe. If you don't owe taxes, the credit can be carried forward to future tax years.

It's important to note that the credit is not a rebate, meaning that you don't get a check from the government for the amount of the credit. Rather, it's a reduction in the amount of taxes you owe.

Reporting Discrepancies Remain

The IRS electric car tax credit program has been in place since 2009, but reporting discrepancies remain. The IRS has issued a report stating that some electric vehicle owners are being understated or overstating their credits, which can result in tax liability and additional penalties. The report states that the IRS has identified the discrepancies, but it has not taken any enforcement action at this time.

Electric Vehicle Tax Credit for 2020

The electric vehicle tax credit for 2020 remains unchanged from previous years. The credit is still available to eligible vehicles and is still based on the battery capacity of the vehicle. However, it's important to note that the credit is not guaranteed and can change at any time based on legislation and manufacturer sales.

Another important thing to keep in mind is that the credit is non-refundable, which means that it can only be used to reduce the amount of taxes you owe, not to receive a refund. If you don't owe taxes, the credit can be carried forward to future tax years.

Qualified Plug-In Electric Drive Motor Vehicle List

The IRS maintains a list of vehicles that are eligible for the plug-in electric drive motor vehicle tax credit. As of 2021, the following vehicles are eligible:

- Audi e-tron Sportback

- BMW i3 and i8

- Cadillac ELR

- Chevrolet Bolt EV and Volt

- Chrysler Pacifica Hybrid

- Fisker Karma

- Ford Fusion Energi and C-Max Energi

- Honda Clarity Fuel Cell and Clarity Plug-in Hybrid

- Hyundai Ioniq Electric, Kona Electric, and Sonata Plug-in Hybrid

- Jaguar I-PACE

- Karma Revero

- Kia Niro EV and Optima Plug-in Hybrid

- MINI Cooper SE

- Mitsubishi i-MiEV and Outlander PHEV

- Nissan LEAF

- Porsche Taycan

- Smart EQ fortwo

- Tesla Model S, Model 3, Model X, and Model Y

- Toyota Prius Prime

- Volkswagen e-Golf and ID.4

What about Commercial and Business Use?

The plug-in electric drive motor vehicle tax credit is also available for qualifying vehicles used for business or commercial purposes. The credit can be claimed by the business or organization that owns or leases the vehicle, and it can be applied to the business or organization's tax liability.

It's important to note that the tax credit cannot be claimed by both the individual and the business or organization for the same vehicle.

Conclusion

The IRS tax credit for qualified plug-in electric drive motor vehicles is an incentive for consumers to switch to more environmentally friendly vehicles. While not all vehicles are eligible for the credit, there are still many options available, and the credit can make a significant difference in the price of a new vehicle. As we move toward a greener future, it's important to take advantage of incentives like these to help make the transition easier.

Remember to do your research and make informed decisions when it comes to purchasing a new vehicle. Consider the environmental impact, the cost, and the available incentives, such as the IRS tax credit for qualified plug-in electric drive motor vehicles. Together, we can make a difference in the fight against climate change.

Stay Informed

Keep up-to-date on the latest news and information about the IRS tax credit for qualified plug-in electric drive motor vehicles by visiting the IRS website or contacting your tax professional.

You can also follow us on social media for updates and news about everything related to electric vehicles, including new vehicles that are eligible for the tax credit and changes to the program.

Join the Movement

Join the movement toward a sustainable future by switching to an electric vehicle and taking advantage of the IRS tax credit for qualified plug-in electric drive motor vehicles. Together, we can make a difference and work toward a brighter future for ourselves and for generations to come.

Contact your local electric company or dealership for more information about electric vehicle options, or visit a local auto show to test drive the latest models. Together, we can make a difference and help to mitigate the damage caused by climate change.

Thank you for doing your part in the fight against climate change. Together, we can make a difference and work toward a better future for all.

If you are searching about IRS Tax Credit for Individuals – What is IRS Tax Credit for Individuals you've came to the right web. We have 8 Images about IRS Tax Credit for Individuals – What is IRS Tax Credit for Individuals like IRS Adds Vehicles to Qualified Plug-in Vehicle List | Haynie & Company, IRS Form 8936 Download Fillable PDF or Fill Online Qualified Plug-In and also IRS Electric-Car Tax Credits: Reporting Discrepancies Remain. Here you go:

IRS Tax Credit For Individuals – What Is IRS Tax Credit For Individuals

irsauditgroup.com

irsauditgroup.com irs individuals

IRS Adds Vehicles To Qualified Plug-in Vehicle List | Haynie & Company

www.hayniecpas.com

www.hayniecpas.com irs qualified jacobson nan

Electric Vehicles | Burlington Electric Department

www.burlingtonelectric.com

www.burlingtonelectric.com irs electric tax credit vehicles

IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug-In

www.templateroller.com

www.templateroller.com irs qualified vehicle templateroller

IRS Electric-Car Tax Credits: Reporting Discrepancies Remain

www.greencarreports.com

www.greencarreports.com electric tax car irs credit sales vehicles qualifying plug purchase nov credits reporting discrepancies remain

Electric Vehicle Tax Credit: What To Know For 2020

www.actionnewsjax.com

www.actionnewsjax.com The IRS Will Reward You For Updating Your Company Website - Get Visible

www.getvisible.com

www.getvisible.com irs

IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug-In

www.templateroller.com

www.templateroller.com irs qualified templateroller

Irs form 8936 download fillable pdf or fill online qualified plug-in. Irs tax credit for individuals – what is irs tax credit for individuals. Irs qualified vehicle templateroller

0 Comments