Electric vehicles are becoming increasingly popular in the United States, and for good reason. They are clean, quiet, and efficient, making them a great choice for those who want to reduce their carbon footprint and save money on fuel costs. However, if you're thinking about buying an electric vehicle, it's important to be aware of the federal tax credits that are available to help offset the higher purchase price. Here's everything you need to know about the federal electric vehicle tax credit.

What is the Federal Electric Vehicle Tax Credit?

The federal electric vehicle tax credit is a financial incentive offered by the US government to encourage the purchase of electric cars. It was introduced in 2008 as part of the Energy Improvement and Extension Act, and since then, it has helped many Americans make the switch to cleaner, greener vehicles.

The credit is available to anyone who purchases a new electric vehicle, and it can be used to help reduce the cost of the car. The amount of the credit varies depending on several factors, such as the size of the battery, the make and model of the car, and the year in which it was purchased.

How Much is the Federal Electric Vehicle Tax Credit?

The federal electric vehicle tax credit can be worth up to $7,500. However, the actual amount of the credit you can receive will depend on the make and model of the electric car you purchase, as well as the size of its battery pack. Here's a breakdown of the maximum federal tax credits available for some of the most popular electric cars on the market today:

- Tesla Model S: $7,500

- Tesla Model X: $7,500

- Tesla Model 3: $7,500

- Chevrolet Bolt EV: $7,500

- Nissan Leaf: $7,500

- Audi e-tron: $7,500

It's important to note that the federal tax credit is not a rebate, meaning that you cannot claim it as a refund on your tax return. Instead, the credit is applied directly to your tax liability, meaning that it can help reduce the amount of federal income tax you owe for the year in which you purchased the car.

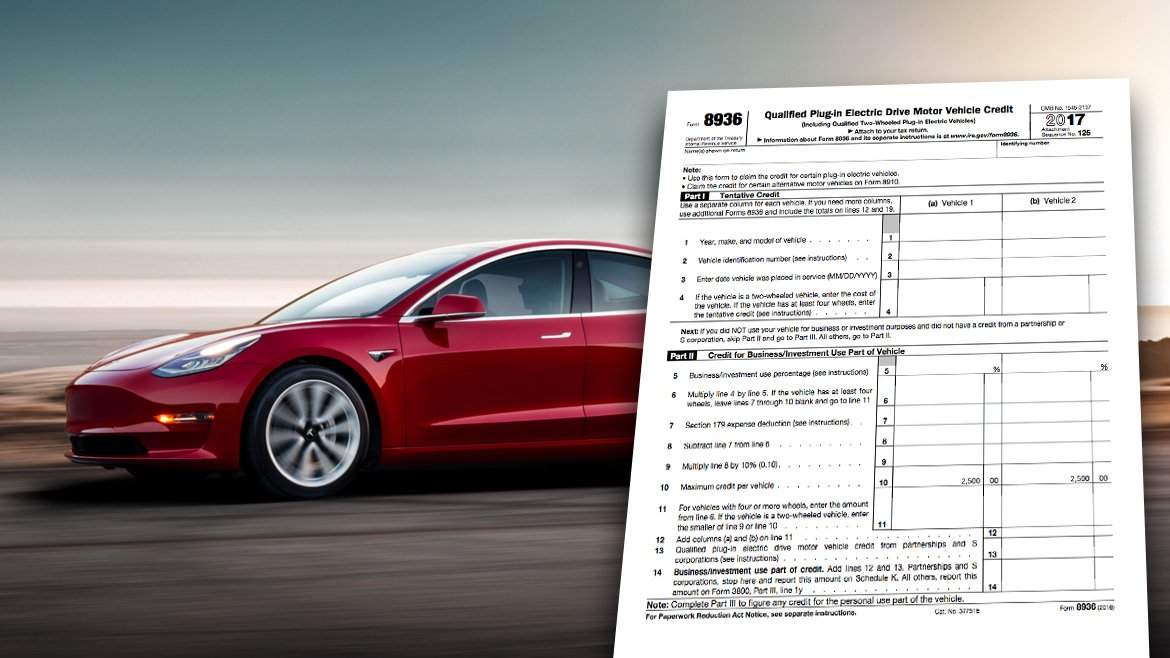

How to Claim the Federal Electric Vehicle Tax Credit

In order to claim the federal electric vehicle tax credit, you will need to file IRS Form 8936 with your tax return for the year in which you purchased the electric car. This will allow you to calculate the amount of the credit you are eligible for and claim it on your tax return.

It's important to note that not all electric vehicles are eligible for the federal tax credit. In order to qualify, the vehicle must meet certain criteria, including:

- It must be a new vehicle purchased by the taxpayer, not a used or leased vehicle.

- It must be primarily designed for use on public streets, roads, and highways.

- It must have a battery pack with a capacity of at least 4 kWh.

- It must be used for personal, not business, purposes.

How the Federal Electric Vehicle Tax Credit Works for Tesla and GM Cars

Recently, the federal electric vehicle tax credit has become a topic of debate, particularly for Tesla and GM cars. In 2019, both companies reached the 200,000-vehicle threshold for the tax credit, which triggered a phase-out period that reduces the amount of the credit over time.

For Tesla, the phase-out period began on January 1, 2019, and the tax credit has since decreased from $7,500 to $1,875. For GM, the phase-out period began on April 1, 2020, and the tax credit has since decreased from $7,500 to $3,750.

This means that if you purchase a Tesla or GM electric car today, you will only be eligible for a partial tax credit. However, if you are considering purchasing a different electric car, such as a Chevrolet Bolt EV or Nissan Leaf, you may still be eligible for the full $7,500 tax credit.

The Future of the Federal Electric Vehicle Tax Credit

The federal electric vehicle tax credit is set to expire for all car manufacturers once they reach the 200,000-vehicle threshold. However, there is currently a bill in Congress that aims to change this and extend the tax credit for all manufacturers.

The bill, called the Driving America Forward Act, was introduced in April 2021 and aims to extend the federal electric vehicle tax credit for 10 years. It would also increase the maximum tax credit to $12,500 and eliminate the 200,000-vehicle cap for all car manufacturers.

If passed, the Driving America Forward Act would be a major win for electric vehicle manufacturers and the environment. It would also make electric cars more affordable for consumers, which could help accelerate the transition to a cleaner, greener transportation system.

Conclusion

Overall, the federal electric vehicle tax credit is an important incentive that can help make electric cars more affordable for American consumers. While the amount of the credit varies depending on several factors, it can be worth up to $7,500 for many popular electric cars on the market today.

If you are considering purchasing an electric vehicle, it's important to be aware of the federal tax credit and how to claim it. By taking advantage of this incentive, you can help save money on the cost of the car and reduce your carbon footprint at the same time.

And with the potential for the Driving America Forward Act to expand and extend the tax credit, the future of electric cars in the United States looks brighter than ever before.

If you are searching about IRS Electric-Car Tax Credits: Reporting Discrepancies Remain you've came to the right place. We have 8 Pictures about IRS Electric-Car Tax Credits: Reporting Discrepancies Remain like Which electric vehicles still qualify for US federal tax credit? - Top, GM Wants Its $7,500 EV Tax Credit Back | The Drive and also Electric car US tax credit proposed to $12,500, less for Tesla vehicles. Read more:

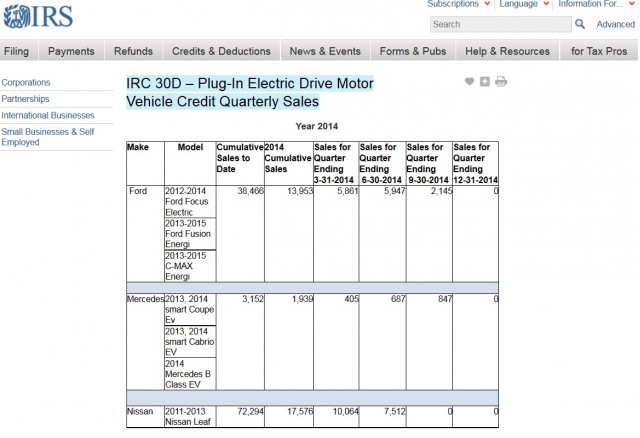

IRS Electric-Car Tax Credits: Reporting Discrepancies Remain

www.greencarreports.com

www.greencarreports.com electric tax car irs credit sales vehicles qualifying plug purchase nov credits reporting discrepancies remain

Electric Vehicle Tax Credit: What To Know For 2020

www.actionnewsjax.com

www.actionnewsjax.com Electric Car US Tax Credit Proposed To $12,500, Less For Tesla Vehicles

gilli-tv.info

gilli-tv.info tesla raising

Which Electric Vehicles Still Qualify For US Federal Tax Credit? - Top

toptech.news

toptech.news vehicles electric federal tax credit 2021 qualify still which entering surge qualifying prospective customers continue sales questions many

US EV Tax Credit Could Be Expanded - Ultra Resources Inc. ULT

ultraresourcesinc.com

ultraresourcesinc.com ev tax credit expanded could powering batteries governments responsible corporations interest currently germany vehicles both electric china these great

GM Wants Its $7,500 EV Tax Credit Back | The Drive

www.thedrive.com

www.thedrive.com euv chevy 2022 redesigned unveils elektroautos tax motor1 intros bangshift pressboltnews quattroruote autonomia aktuellste nachrichten hybride plug

Here’s Why You Should Wait To Buy An Electric Vehicle! (NEW EV Tax

wait

What’s The Federal Tax Credit For Electric Cars In 2021?

marketrealist.com

marketrealist.com electric federal tax credit cars 2021 unsplash source

Vehicles electric federal tax credit 2021 qualify still which entering surge qualifying prospective customers continue sales questions many. Ev tax credit expanded could powering batteries governments responsible corporations interest currently germany vehicles both electric china these great. Gm wants its $7,500 ev tax credit back

0 Comments