Electric vehicles have been gaining popularity over recent years as consumers are increasingly concerned about their carbon footprint and the environment. In addition to being eco-friendly, electric vehicles also come with a range of tax benefits. Here are some of the tax credits for electric and plug-in hybrid vehicles that you need to know:

Tax Credits for Electric Vehicles and Plug-in Hybrids

If you purchase an electric vehicle or plug-in hybrid, you could be eligible for a federal tax credit of up to $7,500. This tax credit is based on the size of the vehicle's battery, with larger batteries receiving a larger credit. In addition to federal tax credits, some states also offer tax incentives for eco-friendly vehicles.

Tax Credits For Electric Vehicles

The federal tax credit for electric vehicles is not unlimited, however. It is important to note that the credit begins to phase out after the manufacturer has sold 200,000 qualifying vehicles in the US. This means that some popular brands such as Tesla and General Motors are no longer eligible for the full tax credit. However, other brands such as Ford and Toyota still offer the full tax credit for their electric vehicles.

Electric Vehicles Tax Credit Program

For those who qualify, the electric vehicle tax credit can be significant. For example, a $7,500 credit can substantially reduce the overall cost of the vehicle. It is important to note that the tax credit is non-refundable, which means that it can only be used to offset your tax liability. If you do not owe any taxes, then you will not be able to take advantage of the credit.

Electric Car Tax

In addition to tax credits, electric vehicles also come with some tax benefits that can help you save money. For example, some states offer reduced vehicle registration fees for eco-friendly vehicles. Other states offer tax deductions for the cost of charging stations or installation fees.

The Tax Benefits of Electric Vehicles

Electric vehicles offer additional benefits beyond just tax credits and deductions. For example, they typically have lower maintenance costs than traditional gasoline-powered vehicles. With fewer moving parts in an electric vehicle engine, there are fewer components that need repair or replacement. This can save you money in the long run, even after factoring in the higher upfront cost of an electric vehicle.

Electric Vehicle Tax Credit: What to Know for 2020

If you are considering purchasing an electric vehicle, make sure you do your research to take full advantage of available tax credits and incentives. The specifics of the tax credit program can vary from state to state, so it is important to consult with a tax professional to determine the best options for you and your situation.

The Power of the Tax Credit for Buying an Electric Vehicle

While the tax credit for electric vehicles can help offset the cost of purchasing a new vehicle, it is important to remember that this is just one piece of the puzzle. You should also consider the long-term costs of owning an electric vehicle, such as maintenance and upkeep costs, insurance premiums, and charging costs.

Electric Car Tax Credits: The Ultimate Guide

Overall, the tax benefits of electric vehicles can make them a smart choice for eco-conscious consumers. With tax credits, reduced registration fees, and other cost savings, purchasing an electric vehicle can make both financial and environmental sense. Keep these tax benefits in mind when shopping for your next vehicle and consult with a tax professional to ensure you are taking full advantage of all available credits and incentives.

If you are looking for The power of the tax credit for buying an electric vehicle - MMKR CPAs you've came to the right page. We have 8 Images about The power of the tax credit for buying an electric vehicle - MMKR CPAs like Tax Credits For Electric Vehicles - TaxProAdvice.com, Electric Car Tax: The benefits of electric vehicles in 2021 | Raw and also Electric Car Tax: The benefits of electric vehicles in 2021 | Raw. Here you go:

The Power Of The Tax Credit For Buying An Electric Vehicle - MMKR CPAs

mmkr.com

mmkr.com electric tax buying vehicle credit power although percentage evs increasing vehicles road cars re today they small

Electric Vehicle Tax Credit: What To Know For 2020

www.actionnewsjax.com

www.actionnewsjax.com Tax Credits For Electric Vehicles - TaxProAdvice.com

www.taxproadvice.com

www.taxproadvice.com The Tax Benefits Of Electric Vehicles - SJC+0 Profit First Accountant

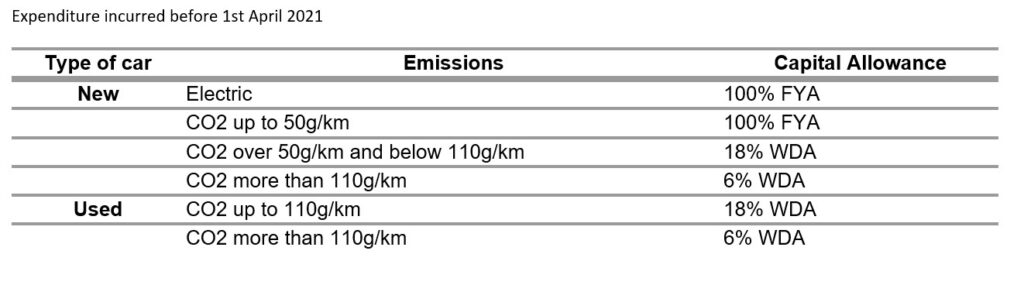

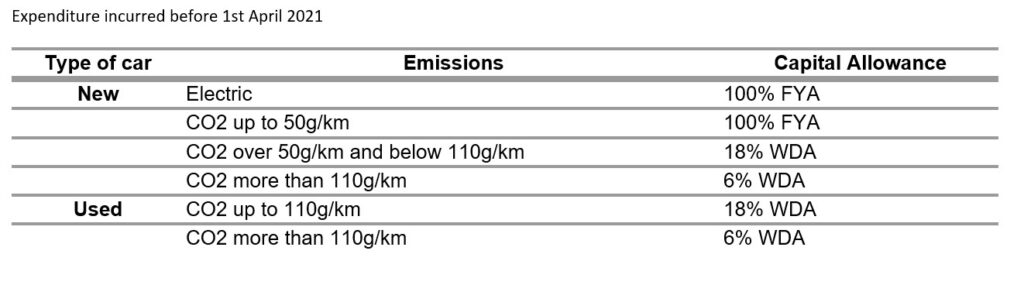

www.sjcplus0.co.uk

www.sjcplus0.co.uk summarised

Electric Car Tax: The Benefits Of Electric Vehicles In 2021 | Raw

rawaccounting.co.uk

rawaccounting.co.uk Tax Credits For Electric Vehicles And Plug-in Hybrids - Williams CPA

williamscpa.us

williamscpa.us hybrids

Electric Car Tax Credits: The Ultimate Guide | Freedom National

freedomgeneral.com

freedomgeneral.com Electric Vehicles Tax Credit Program | Qualifying Vehicles | Bethesda CPA

www.cbmcpa.com

www.cbmcpa.com taxation individuals dealerships cpa

Tax credits for electric vehicles and plug-in hybrids. Electric vehicle tax credit: what to know for 2020. Electric vehicles tax credit program

0 Comments