Electric cars have been gaining popularity as an eco-friendly alternative to traditional vehicles. In addition to its obvious environmental benefits, electric cars also offer a number of tax incentives that can benefit consumers. In fact, the IRS has recently added some vehicles to the qualified plug-in vehicle list, which means that they are eligible for a tax credit. Let's take a look at what this means for electric car owners.

Qualified Plug-In Vehicle List

The IRS updates the qualified plug-in vehicle list every year to include new vehicles that are eligible for the tax credit. For the 2021 tax year, the following electric cars are eligible for the full $7,500 tax credit:

- BMW i3

- Buick Encore EV

- Chevrolet Bolt EV

- Ford Mach-E

- Kia Niro EV

- Mini Cooper SE

- Nissan LEAF

- Polestar 2

- Tesla Model 3

- Tesla Model S

- Tesla Model X

- Volkswagen ID.4

Keep in mind that there is a phase-out period for the tax credit that varies depending on the automaker. Once an automaker sells 200,000 electric vehicles, the tax credit starts to phase out. This means that the full $7,500 credit is only available for a limited period of time before it starts to decrease. Be sure to check with your tax professional to see if the vehicle you are considering is eligible for the full tax credit.

Tax Credits for Electric Cars

In addition to the federal tax credit, some states also offer additional incentives for electric car owners. For example, California offers a $2,000 rebate on top of the federal tax credit. Other states offer perks such as carpool lane access, free parking and charging, and reduced vehicle registration fees. Be sure to check with your state's Department of Motor Vehicles to see what incentives are available in your area.

It's worth noting that the tax credit is not a deduction, but rather a credit. This means that the credit is subtracted directly from the amount of tax that you owe. For example, if you owe $10,000 in taxes and receive a $7,500 tax credit, you would only owe $2,500 in taxes. Keep in mind that you must have a tax liability in order to take advantage of the tax credit. If you do not owe any taxes, you will not be able to use the credit.

Child Tax Credit

The child tax credit is a tax credit that helps parents with the cost of raising children. For the 2021 tax year, the child tax credit has been expanded to provide even more support. The credit is now worth up to $3,600 per child under the age of 6 and up to $3,000 per child between the ages of 6 and 17. The credit begins to phase out for individuals with incomes above $75,000 or couples with incomes above $150,000.

In addition to the expanded credit, the IRS has also introduced an advanced payment system for the child tax credit. Eligible families will receive advance payments of up to $300 per child per month starting in July and running through December. These payments will be based on the information from your 2020 tax return, or your 2019 tax return if your 2020 return has not yet been processed.

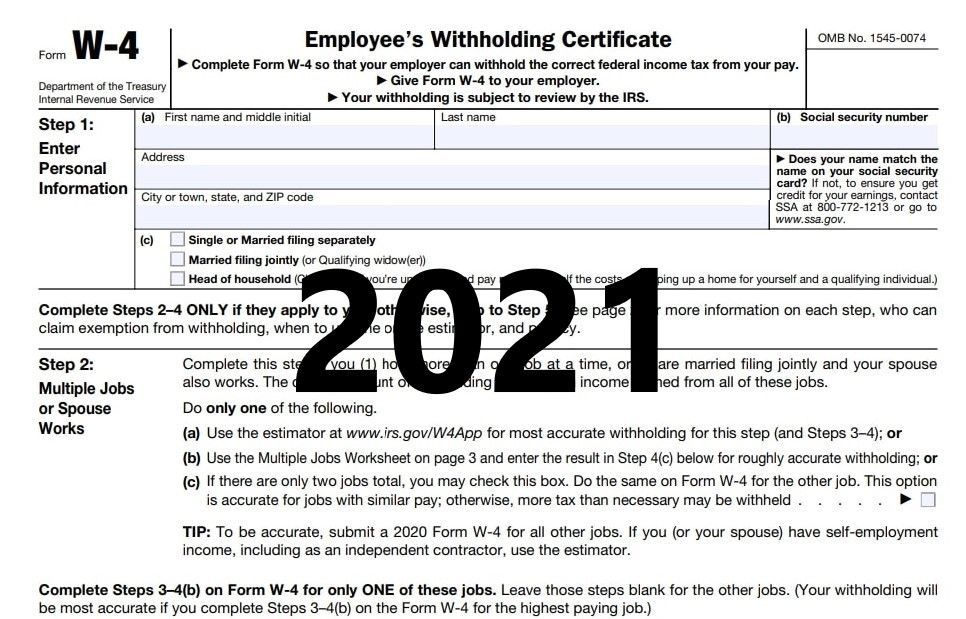

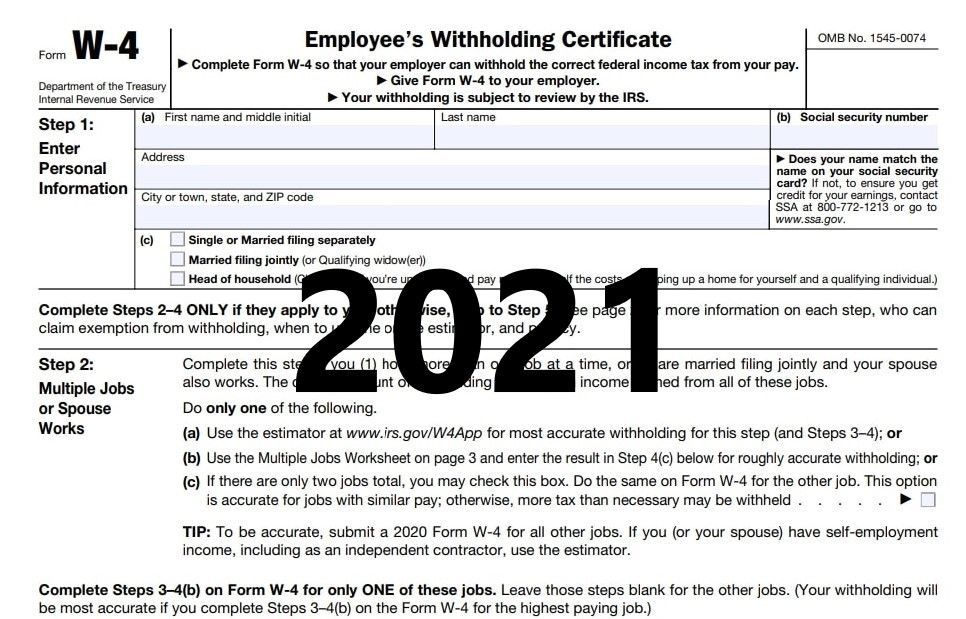

Tax Withholding Estimator

The IRS tax estimator is a tool that can help you figure out how much tax you will owe for the year. This can be especially helpful if you have experienced any major life changes, such as a new job, retirement, or getting married. The estimator takes into account your income, deductions, and credits to give you an estimate of your tax liability for the year.

The tax estimator can also be helpful for determining how much tax you should be withholding from each paycheck. If you are overpaying or underpaying your taxes, it can result in a big tax bill or a smaller refund at the end of the year. By using the estimator, you can adjust your tax withholding to ensure that you are paying the correct amount throughout the year.

Elderly or Disabled Tax Credit

The elderly or disabled tax credit is a credit that is available to taxpayers who are age 65 or older, or who are retired on permanent and total disability. The credit is worth up to $7,500 and is based on your income, filing status, and age or disability status.

To claim the credit, you must file a Form 1040 or 1040-SR with the IRS. You must also meet certain income requirements. For example, if you are single and your adjusted gross income (AGI) is more than $17,500, you will not be eligible for the credit. For married couples filing jointly, the AGI limit is $20,000.

Federal Tax Credit for EV Purchases and Chargers

The federal tax credit for EV purchases and chargers has been reinstated for 2018-2020. This credit provides a 30% tax credit for the cost of purchasing and installing an EV charging station at your home. The maximum credit is $1,000 for residential installations and $30,000 for commercial installations.

In addition to the charging station credit, there is also a federal tax credit available for purchasing an electric vehicle. The amount of the credit varies depending on the make and model of the vehicle, but can be up to $7,500.

As you can see, there are a number of tax incentives available for electric car owners and those who are eligible for certain tax credits. Be sure to consult with your tax professional to see what credits and deductions you may be eligible for, and how you can take advantage of them.

If you are looking for IRS Tax Estimator 2021 - Tax Withholding Estimator 2021 you've visit to the right place. We have 8 Pics about IRS Tax Estimator 2021 - Tax Withholding Estimator 2021 like Irs Child Tax Credit 2021 Check Status | Cahunit.com, IRS Adds Vehicles to Qualified Plug-in Vehicle List | Haynie & Company and also 2021 IRS Tax Updates - Ineo Global Mobility. Here you go:

IRS Tax Estimator 2021 - Tax Withholding Estimator 2021

taxwithholdingestimator.com

taxwithholdingestimator.com w4 irs withholding estimator exemptions taxw taxes

IRS Tax Notices Explained - Landmark Tax Group

landmarktaxgroup.com

landmarktaxgroup.com irs tax notices explained letter notice 2021 if find

2021 IRS Tax Updates - Ineo Global Mobility

www.ineomobility.com

www.ineomobility.com tax irs updates 2021 update october

Federal Tax Credit Reinstated For 2018-2020 EV Purchases And Chargers

ev4corners.org

ev4corners.org The Elderly Or Disabled Irs Tax Credit For 2021 Details. | Turbo Tax

turbo-tax.org

turbo-tax.org disabled elderly irs spouse deduction

IRS Adds Vehicles To Qualified Plug-in Vehicle List | Haynie & Company

www.hayniecpas.com

www.hayniecpas.com irs qualified jacobson nan

What Is The Tax Credit For Electric Cars 2020, 2021? | Tax Credits, Irs

www.pinterest.com

www.pinterest.com cars

Irs Child Tax Credit 2021 Check Status | Cahunit.com

cahunit.com

cahunit.com irs refundtalk cahunit taxability portals

Irs child tax credit 2021 check status. Disabled elderly irs spouse deduction. Irs adds vehicles to qualified plug-in vehicle list

0 Comments