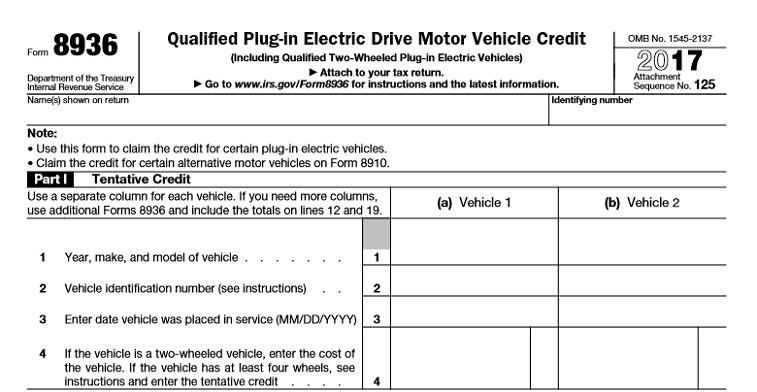

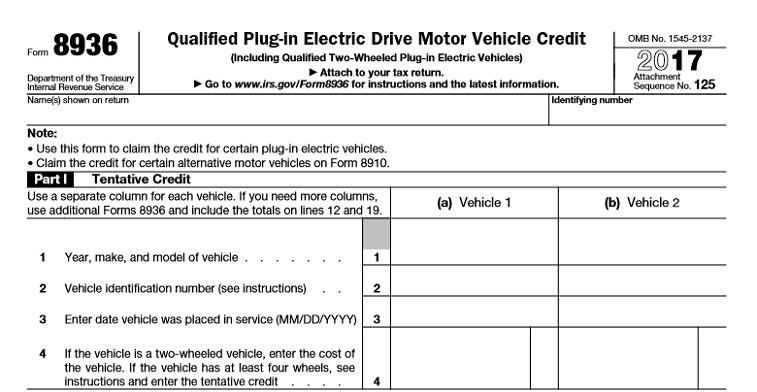

Electric Vehicle Tax Credit: A Complete Guide Electric vehicles (EVs) have become increasingly popular in recent years due to a growing concern for the environment and a push towards sustainable transportation. If you are considering buying an electric vehicle, the federal government offers a tax credit that can help offset the cost. In this guide, we will provide you with a complete overview of the electric vehicle tax credit, including how it works, who qualifies, and how much money you can save. How does the Electric Vehicle Tax Credit Work? The electric vehicle tax credit is a federal incentive designed to encourage people to purchase electric vehicles. The credit is designed to offset the higher cost of electric vehicles compared to traditional gasoline-powered vehicles. The credit is applied to your federal income tax and can be taken in the year the vehicle was purchased or leased. Who Qualifies for the Electric Vehicle Tax Credit? To qualify for the electric vehicle tax credit, your vehicle must meet certain criteria. First, the vehicle must be new and purchased or leased after December 31, 2009. Second, the vehicle must be primarily powered by an electric motor and rechargeable battery, which means that it must have a battery that can be charged by an external source. Finally, the vehicle must meet certain battery capacity requirements. The amount of the tax credit is also dependent on the battery capacity of the vehicle. Vehicles with a battery capacity of 16 KWh or more qualify for the maximum tax credit of $7,500. Vehicles with a battery capacity between 5 KWh and 16 KWh qualify for a partial tax credit, while vehicles with a battery capacity of less than 5 KWh do not qualify for the tax credit. How Much Money can You Save with the Electric Vehicle Tax Credit? The amount of money you can save with the electric vehicle tax credit depends on several factors, including the type of vehicle you purchase, its battery capacity, and your tax liability. As mentioned earlier, the maximum tax credit is $7,500, which applies to vehicles with a battery capacity of 16 KWh or more. Vehicles with a battery capacity between 5 KWh and 16 KWh qualify for a partial tax credit, which is calculated based on a formula that takes into account the battery capacity and the base tax credit amount. It’s important to note that the tax credit is non-refundable, which means that you can only use it to offset your federal income tax liability. If your tax liability is less than the amount of the tax credit, you will not receive the remaining balance as a refund. However, if you cannot use the full amount of the tax credit in the year you purchased or leased the vehicle, you can carry the unused portion forward to future tax years. How to Claim the Electric Vehicle Tax Credit To claim the electric vehicle tax credit, you must file IRS Form 8936, which is titled “Qualified Plug-In Electric Drive Motor Vehicle Credit.” You must attach this form to your federal income tax return for the year you purchased or leased the vehicle. The form requires you to provide information about the vehicle, including the make and model, the date of purchase or lease, and the battery capacity. If you leased the vehicle and the lessor claimed the tax credit, you cannot claim the tax credit. However, if the lessor did not claim the tax credit, you may be able to claim the tax credit as the lessee, depending on the terms of your lease agreement. The fine print of the Electric Vehicle Tax Credit It’s important to understand that the electric vehicle tax credit is subject to certain limitations and restrictions. For example, the tax credit begins to phase out once a manufacturer has sold a certain number of vehicles. For example, once a manufacturer has sold 200,000 electric vehicles, the tax credit begins to phase out for that manufacturer’s vehicles. Tesla, for example, has already reached this limit, which means that no new Tesla vehicles are eligible for the tax credit. Additionally, the tax credit is subject to the Alternative Minimum Tax (AMT), which is a separate tax system designed to ensure that high-income taxpayers pay a minimum amount of tax. If you are subject to the AMT, you may not be able to claim the full amount of the tax credit. Another important note is that the electric vehicle tax credit is set to expire on December 31, 2021. While there is a push to extend the tax credit, it is not guaranteed. Therefore, if you are considering purchasing an electric vehicle, it may be a good idea to do so sooner rather than later to take advantage of the tax credit before it expires. Why Electric Vehicles are important? Electric vehicles are becoming increasingly important in the effort to reduce greenhouse gas emissions and combat climate change. Transportation is responsible for approximately 28% of greenhouse gas emissions in the United States, and the majority of those emissions come from traditional gasoline-powered vehicles. Electric vehicles produce little to no emissions, making them a much cleaner alternative to traditional vehicles. In addition to their environmental benefits, electric vehicles also offer other advantages over traditional vehicles. For example, electric vehicles are much quieter than traditional vehicles, and they require less maintenance because they have fewer moving parts. And while the up-front cost of electric vehicles can be higher than traditional vehicles, the savings on fuel and maintenance costs can make up for that difference over time. In conclusion, the electric vehicle tax credit is an incentive designed to encourage people to purchase electric vehicles. If you are considering purchasing an electric vehicle, the tax credit can help offset the higher upfront cost. However, there are certain limitations and restrictions to be aware of, and the credit is set to expire at the end of 2021. Nonetheless, electric vehicles offer numerous benefits, including reduced greenhouse gas emissions and lower fuel and maintenance costs, making them an important part of the effort towards a sustainable future.

If you are searching about Electric vehicle tax credit survives in latest tax bill, but phase out you've visit to the right place. We have 8 Images about Electric vehicle tax credit survives in latest tax bill, but phase out like Electric Vehicle Tax Credits: What You Need to Know - Doty Pruett and, 'Surprise' Increase on Electric Vehicles' Tax in Jordan | Al Bawaba and also Electric Vehicle Tax Credits: What You Need to Know - Doty Pruett and. Here it is:

Electric Vehicle Tax Credit Survives In Latest Tax Bill, But Phase Out

www.freep.com

www.freep.com bolt zippy mainstream ev survives incentives congressional conferees dropped wipe

Electric Vehicle Tax Credit: What To Know For 2020 – Action News Jax

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) www.actionnewsjax.com

www.actionnewsjax.com calculate

A Complete Guide To The Electric Vehicle Tax Credit

www.greenmatters.com

www.greenmatters.com qualify greenmatters

Claiming The $7,500 Electric Vehicle Tax Credit: A Step-by-Step Guide

www.cheatsheet.com

www.cheatsheet.com irs step claiming cheatsheet

Electric Vehicle Tax Credits: What You Need To Know - Doty Pruett And

dpwcpas.com

dpwcpas.com ev electrek money qualify

The Power Of The Tax Credit For Buying An Electric Vehicle - MMKR CPAs

mmkr.com

mmkr.com electric tax buying vehicle credit power although percentage evs increasing vehicles road cars re today they small

Electric Vehicle Tax Credit Update For New Models | Fuoco Group

www.fuoco.cpa

www.fuoco.cpa kaplan

'Surprise' Increase On Electric Vehicles' Tax In Jordan | Al Bawaba

www.albawaba.com

www.albawaba.com tax electric stacking businessman coins table car shutterstock increase surprise jordan vehicles evs customs increased zero per january been cent

Claiming the $7,500 electric vehicle tax credit: a step-by-step guide. Ev electrek money qualify. Electric vehicle tax credit: what to know for 2020 – action news jax

www.freep.com

www.freep.com :quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) www.actionnewsjax.com

www.actionnewsjax.com  www.greenmatters.com

www.greenmatters.com  www.cheatsheet.com

www.cheatsheet.com  dpwcpas.com

dpwcpas.com  mmkr.com

mmkr.com  www.fuoco.cpa

www.fuoco.cpa  www.albawaba.com

www.albawaba.com

0 Comments