Are you in the market for a new car or making updates to your home? With tax season upon us, it's important to know what tax credits are available in 2021. From electric vehicles to energy-efficient upgrades, there are many options to save money while also doing your part for the environment.

Electric Vehicle Tax Credit

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

If you're considering purchasing an electric vehicle, there are tax credits available to help offset the cost. The credit amount varies based on the vehicle and battery size, but it can be up to $7,500. These tax credits began to phase out for certain automakers in 2020, but there are still options available. Be sure to do your research and talk to a tax professional to determine if you qualify and how much you can save.

Energy Efficient Home Upgrades

Making energy-efficient upgrades to your home not only lowers your monthly bills, but it can also provide tax credits. Installing energy-efficient windows, doors, roofs, and insulation can lead to a tax credit of up to $500. These credits are available through 2021, so consider making updates before the end of the year to take advantage of the program.

Child Tax Credit

If you have children, you may qualify for a child tax credit. The credit amount is up to $2,000 per child and begins to phase out for incomes over $200,000 for single filers and $400,000 for married filers. This credit can help lower your tax bill or increase your refund, so be sure to include all eligible dependents on your tax return.

Solar Energy Tax Credit

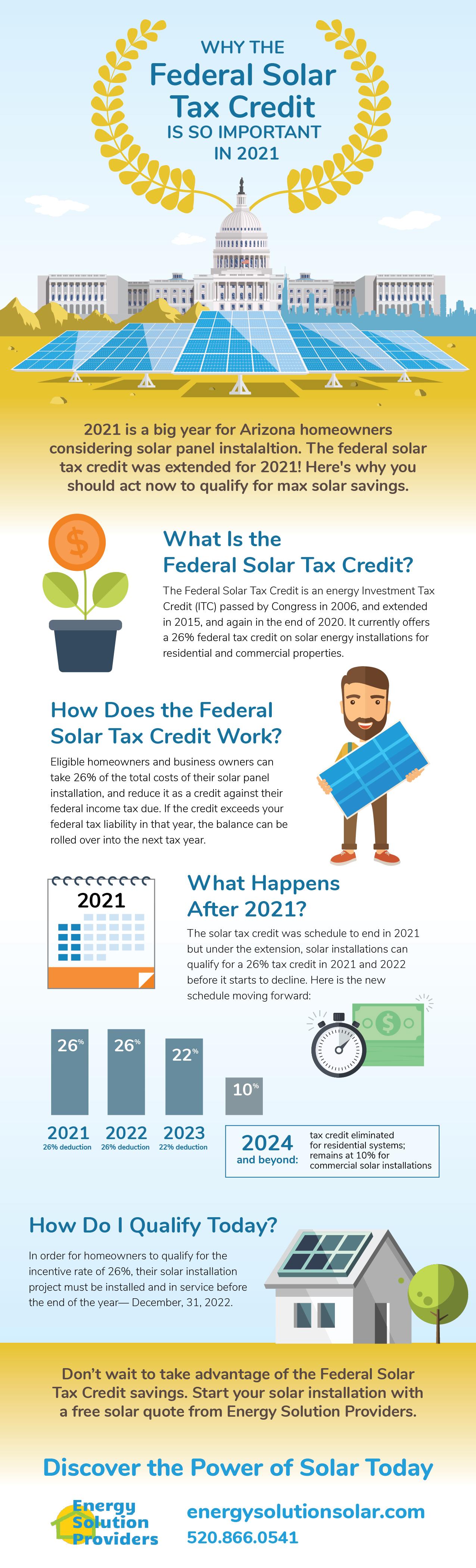

Installing solar panels on your home not only helps the environment, but it can also provide significant tax credits. The federal solar tax credit is available for 26% of the total cost of the system. This credit is set to begin phasing out in 2022, so consider making the switch to solar energy while the credit is still available.

Electric Vehicle Charging Infrastructure Tax Credit

In addition to tax credits for electric vehicles, there are also credits available for installing electric vehicle charging infrastructure. The credit is up to 30% of the total cost of the installation, with a cap of $1,000 for home charging stations. This credit is available through 2021, so consider installing a charging station to make it more convenient to charge your electric vehicle.

Conclusion

While tax season may not be the most exciting time of year, there are opportunities to save money through tax credits. Consider these options when making car or home upgrades, or if you have dependents. Be sure to talk to a tax professional or visit the IRS website for more information on eligibility and credit amounts.

If you are searching about Child Tax Credit 2021 you've came to the right place. We have 8 Pics about Child Tax Credit 2021 like Federal Solar Tax Credit 2021: What You Need to Know | Verogy, The Federal Solar Tax Credit | Energy Solution Providers | Arizona and also Federal Solar Tax Credit 2021: What You Need to Know | Verogy. Read more:

Child Tax Credit 2021

www.1040form2021.com

www.1040form2021.com Here’s Why You Should Wait To Buy An Electric Vehicle! (NEW EV Tax

wait

Energy Efficient Windows Tax Credit 2021 – Alliance Of Youth Leaders

aylus.org

aylus.org Tax Credits Renewed For 2021!

www.bakkenelectric.com

www.bakkenelectric.com renewed

Electric Vehicle Tax Credit Update For New Models | Fuoco Group

www.fuoco.cpa

www.fuoco.cpa kaplan

The Federal Solar Tax Credit | Energy Solution Providers | Arizona

energysolutionsolar.com

energysolutionsolar.com solar credit tax federal 2021 arizona important why so

Federal Solar Tax Credit 2021: What You Need To Know | Verogy

www.verogy.com

www.verogy.com tax solar credit 2021 federal need know

Electric Vehicle Tax Credit: What To Know For 2020 – Action News Jax

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) www.actionnewsjax.com

www.actionnewsjax.com calculate

Solar credit tax federal 2021 arizona important why so. Here’s why you should wait to buy an electric vehicle! (new ev tax. Electric vehicle tax credit: what to know for 2020 – action news jax

0 Comments